Get ready to dive into the world of Retirement savings plans, where financial security meets savvy planning. This intro sets the stage for an enlightening journey through the ins and outs of securing your future wealth.

Let’s break down the different types of retirement savings plans, strategies to maximize your savings, and common pitfalls to avoid. Buckle up, it’s gonna be a wild ride!

Importance of Retirement Savings Plans

Saving for retirement is crucial for ensuring financial security in the future. Without a retirement savings plan, individuals may face a significant financial burden during their retirement years. It is essential to start planning and saving early to build a substantial nest egg for the future.

Benefits of Starting a Retirement Savings Plan Early

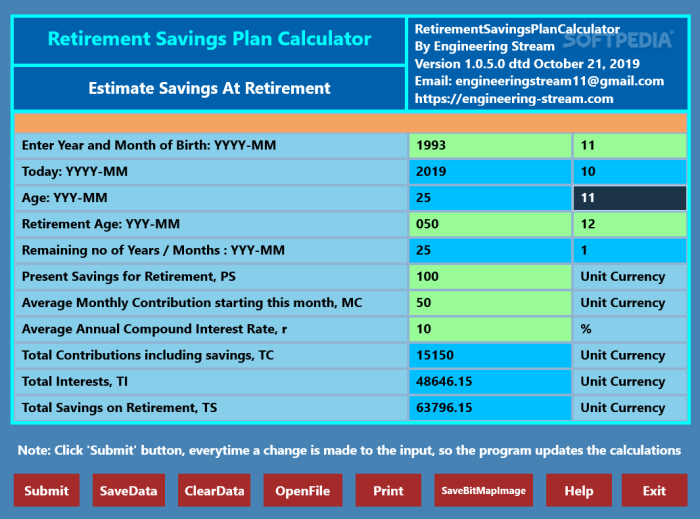

- Compound Interest: Starting early allows your investments to grow over time through the power of compound interest. This means you can earn interest on both your initial investment and the interest that has already been added to your account.

- Long-Term Growth: By investing early, you have more time to ride out market fluctuations and benefit from long-term growth in the stock market.

- Lower Risk: Starting early gives you the flexibility to take more risks with your investments, as you have time to recover from any potential losses.

Impact of Not Having a Retirement Savings Plan

Not having a retirement savings plan can have serious consequences. Without adequate savings, individuals may have to rely solely on social security benefits, which may not be enough to cover living expenses in retirement. According to a study by the National Institute on Retirement Security, nearly 40 million households in the U.S. have no retirement savings at all, leaving them vulnerable to financial hardship in their later years.

Types of Retirement Savings Plans

When it comes to saving for retirement, there are several options available to help you build a nest egg for your golden years. Let’s take a closer look at some of the most common types of retirement savings plans.

401(k) Plans

A 401(k) plan is a retirement savings account offered by many employers. With a traditional 401(k), you can contribute a portion of your pre-tax income to your account, which can help reduce your taxable income. Some employers also offer a match on your contributions, providing free money to boost your retirement savings. Withdrawals from a 401(k) are taxed as ordinary income and may be subject to penalties if taken before age 59 ½.

Individual Retirement Accounts (IRAs)

IRAs are retirement savings accounts that individuals can open on their own. There are two main types of IRAs: traditional and Roth. With a traditional IRA, your contributions are typically tax-deductible, but you’ll pay taxes on withdrawals in retirement. On the other hand, Roth IRAs are funded with after-tax dollars, so withdrawals in retirement are tax-free. Both traditional and Roth IRAs have income limits for eligibility.

Pension Plans

Pension plans, also known as defined benefit plans, are retirement plans offered by some employers. With a pension plan, your employer contributes to a fund that will provide you with a steady income in retirement. Pension plans are becoming less common in the private sector, but some government agencies and large corporations still offer them. The benefit you receive from a pension plan is typically based on your years of service and salary.

Tax Implications

Understanding the tax implications of different retirement savings plans is crucial for maximizing your savings. Contributions to traditional 401(k)s and IRAs are tax-deductible, which can lower your taxable income. However, withdrawals from these accounts in retirement are taxed as ordinary income. On the other hand, contributions to Roth IRAs are made with after-tax dollars, so withdrawals in retirement are tax-free. It’s important to consider your current tax situation and future tax implications when choosing a retirement savings plan.

Strategies for Maximizing Retirement Savings

To secure a comfortable retirement, it’s essential to maximize contributions to your retirement savings plan. By implementing effective strategies, individuals can build a robust financial cushion for their golden years.

Employer Matching Contributions

Employer matching contributions are a key way to boost retirement savings. This benefit essentially means that your employer will match a certain percentage of the contributions you make to your retirement account. It’s essentially free money that can significantly increase your savings over time. Make sure to take full advantage of this perk by contributing enough to receive the maximum matching amount offered by your employer.

Adjusting Strategies Based on Life Stages

As you progress through different life stages or financial goals, it’s important to adjust your retirement savings strategies accordingly. For example, when you’re younger and have more time until retirement, you may choose to invest more aggressively to potentially earn higher returns. On the other hand, as you near retirement age, you may want to shift towards more conservative investments to protect your savings from market volatility.

Automating Contributions

One effective strategy is to automate your contributions to your retirement savings plan. By setting up automatic transfers from your paycheck or bank account, you ensure that you consistently save towards your retirement without having to think about it. This can help you stay disciplined and avoid the temptation to spend that money elsewhere.

Increasing Contributions Over Time

Another strategy is to gradually increase your contributions to your retirement savings plan as your income grows. By dedicating a portion of any salary increases or bonuses towards your retirement savings, you can accelerate the growth of your nest egg without significantly impacting your current lifestyle.

Challenges and Common Mistakes in Retirement Savings

Saving for retirement can be challenging, especially with the various financial obligations individuals face throughout their lives. It’s important to be aware of common challenges and mistakes to ensure a secure financial future.

Challenge: Lack of Consistent Savings

One common challenge people face is the inability to consistently save for retirement. Many individuals struggle to set aside a portion of their income regularly due to competing financial priorities.

- Set up automatic contributions: Consider automating your retirement savings by setting up recurring transfers from your paycheck to your retirement account. This way, you won’t have to rely on remembering to make contributions each month.

- Create a budget: Establish a budget that Artikels your income and expenses to identify areas where you can cut back and allocate more funds towards retirement savings.

- Start small and increase gradually: If you find it difficult to save a significant amount initially, start with a smaller contribution and gradually increase it as your financial situation improves.

Common Mistake: Ignoring Investment Diversification

Another common mistake individuals make is failing to diversify their investment portfolio within their retirement savings plan. By putting all their eggs in one basket, they expose themselves to unnecessary risk.

- Allocate assets across different investment vehicles: Spread your investments across a mix of stocks, bonds, and other assets to minimize risk and maximize returns.

- Regularly review and rebalance your portfolio: Monitor your investments regularly and make adjustments as needed to ensure your portfolio remains diversified and aligned with your risk tolerance.

- Seek professional advice: Consider consulting a financial advisor who can provide guidance on proper asset allocation and diversification strategies based on your financial goals and risk tolerance.