Understanding mutual fund fees is key to navigating the world of investments like a pro. From unraveling the impact of fees on your returns to exploring the different types of fees, this topic is a must-know for any savvy investor. Get ready to dive into the details and demystify the world of mutual fund fees.

Importance of Understanding Mutual Fund Fees

Investors must have a clear understanding of mutual fund fees as they can significantly impact investment returns. These fees can eat into your profits and reduce the overall performance of your investment.

Types of Mutual Fund Fees

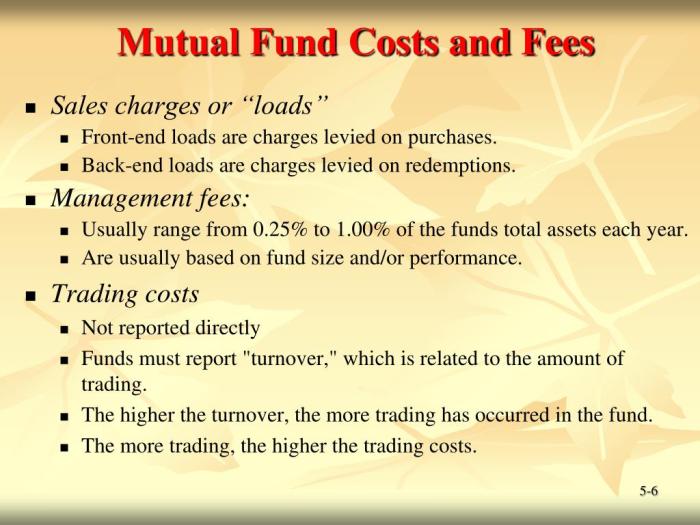

- Management Fees: These fees are charged by the fund manager for managing the fund’s portfolio. They are typically a percentage of the assets under management.

- Expense Ratios: This represents the total annual operating expenses of a mutual fund as a percentage of the fund’s average net assets. It includes management fees, administrative costs, and other expenses.

- Load Fees: These are sales charges that investors pay when buying or selling mutual fund shares. Front-end loads are paid when purchasing shares, while back-end loads are paid when selling shares.

- Performance Fees: Some mutual funds charge performance fees based on the fund’s performance compared to a benchmark.

Types of Mutual Fund Fees

When investing in mutual funds, it’s important to understand the various types of fees that can impact your investment performance. Here, we will explore the different types of fees charged by mutual funds and how they can affect your returns.

Management Fees

Management fees are charges paid to the fund manager for managing the investments in the fund. These fees are typically calculated as a percentage of the fund’s assets under management. The higher the management fee, the more you will pay for the fund’s management services, potentially reducing your overall returns.

Administrative Fees

Administrative fees cover the costs of maintaining the fund, including record-keeping, customer service, and other administrative tasks. These fees are also expressed as a percentage of the fund’s assets under management and can vary depending on the complexity of the fund’s operations.

Sales Charges (Loads)

Sales charges, also known as loads, are fees that investors pay when buying or selling mutual fund shares. There are two main types of sales charges: front-end loads, which are paid when purchasing shares, and back-end loads, which are paid when selling shares. These charges can significantly impact your investment returns, especially if you are making frequent transactions.

Impact of Fee Structures on Investment Performance

The fee structure of a mutual fund can have a significant impact on your investment performance. Funds with higher fees may have to achieve higher returns to offset those costs, making it more challenging to outperform the market. Conversely, funds with lower fees can provide better returns to investors over time, as less of the fund’s earnings are being used to cover expenses.

Variation in Fee Structures

Fee structures can vary between different types of mutual funds. For example, index funds typically have lower fees compared to actively managed funds since they aim to replicate a specific market index rather than actively pick investments. It’s essential to consider the fee structure of a fund in relation to its investment strategy and performance potential.

Fee Calculation Methods

When it comes to mutual fund fees, the way they are calculated can vary based on different factors such as the fund’s investment strategy or size. Understanding how these fees are determined is crucial for investors to make informed decisions about where to put their money.

Percentage of Assets Under Management

- One common method for calculating mutual fund fees is as a percentage of assets under management. This means that investors pay a certain percentage of the total value of their investments in the fund as a fee.

- For example, if a mutual fund charges a 1% fee and an investor has $10,000 invested in the fund, they would pay $100 in fees annually.

Flat Fees

- Some mutual funds charge flat fees, which are fixed amounts that investors must pay regardless of the size of their investment in the fund.

- For instance, a fund may charge a flat fee of $50 per year per investor, regardless of whether they have $1,000 or $10,000 invested in the fund.

Differences Based on Investment Strategy or Size

- Fee calculations can differ based on a fund’s investment strategy. For example, actively managed funds that require more research and trading may have higher fees compared to passively managed index funds.

- Additionally, larger funds may be able to negotiate lower fees due to economies of scale, while smaller funds may have higher fees to cover their operating costs.

Transparency of Fee Calculations

- It is important for investors to know how mutual fund fees are calculated and be able to access this information easily.

- Most funds are required to disclose their fee structures in documents like the prospectus, which provides transparency for investors to understand what they are paying for.

- Investors can also find fee information on the fund’s website or by contacting the fund directly to inquire about fee calculations.

Fee Disclosures and Reporting

When it comes to mutual fund fees, transparency is key. Regulations and requirements are in place to ensure that investors have access to clear and accurate information regarding the fees associated with their investments.

Regulations and Requirements

- Regulators like the Securities and Exchange Commission (SEC) mandate that mutual funds disclose all fees and expenses in a clear and understandable manner.

- These disclosures are typically made in the fund’s prospectus, which is a legal document that provides detailed information about the fund’s objectives, strategies, risks, and costs.

- Additionally, mutual funds are required to provide a summary prospectus, which highlights key information, including fees, in a concise format.

Presentation of Fee Information

- Fee information is usually presented in a fee table within the fund documents, outlining various charges such as management fees, administrative fees, and 12b-1 fees.

- Investors can also find fee details in the fund’s annual and semi-annual reports, which provide a breakdown of expenses incurred by the fund.

Importance of Clear Reporting

- Clear and transparent fee reporting is crucial for investors to make informed decisions about their investments.

- Understanding the fees associated with a mutual fund helps investors assess the overall cost of investing and evaluate the fund’s performance net of fees.

- By having access to fee disclosures and reports, investors can compare different funds more effectively and choose investments that align with their financial goals.