As we delve into the intricate world of loan application process explained, we uncover the essential steps and key documents that shape this financial journey. From understanding the types of loans to preparing financially and submitting the application, this guide offers a roadmap to navigate the complexities of borrowing money.

Let’s explore the nuances of loan applications and empower you with the knowledge to make informed financial decisions.

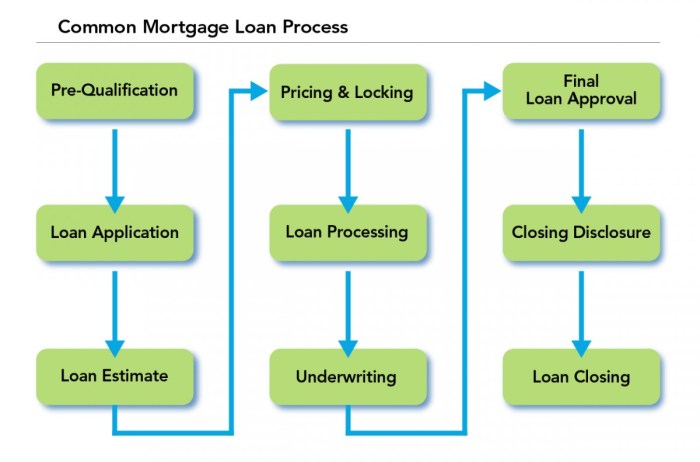

Loan Application Process Overview

When applying for a loan, there are several key steps that need to be followed to ensure a smooth process. From gathering the necessary documents to final approval, each step plays a crucial role in determining whether your loan application will be successful or not.

General Steps in Loan Application Process

- 1. Application: The first step is to fill out a loan application form provided by the lender. This form will ask for personal information, employment details, income, and the amount you wish to borrow.

- 2. Documentation: Once the application is submitted, you will need to provide supporting documents such as identification, proof of income, bank statements, and any other documents requested by the lender.

- 3. Credit Check: The lender will conduct a credit check to assess your creditworthiness and determine the risk of lending to you. A good credit score increases your chances of loan approval.

- 4. Verification: The lender will verify the information provided in your application and documents. This may involve contacting your employer, bank, or other third parties to confirm the details.

- 5. Approval: If all the information checks out and you meet the lender’s criteria, your loan application will be approved. You will receive the terms of the loan, including interest rate, repayment schedule, and any fees.

- 6. Disbursement: Once you accept the loan terms, the funds will be disbursed to your account. You can then use the money for the intended purpose, whether it’s buying a car, home improvements, or consolidating debt.

Key Documents Required for Loan Application

- – Identification: Driver’s license, passport, or other government-issued ID.

- – Proof of Income: Pay stubs, tax returns, bank statements, or employment verification letter.

- – Bank Statements: To show your financial stability and ability to repay the loan.

- – Credit Report: The lender will obtain this to assess your credit history and score.

- – Loan Application Form: Filled out with accurate information about your personal and financial details.

Importance of Each Step in Loan Application Process

- – Application: Provides the lender with necessary information to assess your eligibility for a loan.

- – Documentation: Verifies the information provided and supports your financial stability and ability to repay the loan.

- – Credit Check: Determines your creditworthiness and helps the lender assess the risk of lending to you.

- – Verification: Ensures the accuracy of the information provided and confirms your ability to meet the loan obligations.

- – Approval: Finalizes the terms of the loan and sets the stage for disbursing the funds to you.

- – Disbursement: Provides you with access to the funds for your intended use, completing the loan process.

Types of Loans

When it comes to borrowing money, there are various types of loans that consumers can choose from based on their needs and financial situation. Let’s take a look at some common types of loans available in the market.

Secured vs Unsecured Loans

Secured Loans:

– Secured loans are backed by collateral, such as a car or a house, which the lender can seize if the borrower fails to repay the loan.

– Examples of secured loans include mortgages and auto loans.

– Secured loans typically have lower interest rates compared to unsecured loans due to the reduced risk for the lender.

Unsecured Loans:

– Unsecured loans do not require any collateral, making them more accessible to a wider range of borrowers.

– Examples of unsecured loans include personal loans and credit cards.

– Unsecured loans usually have higher interest rates since the lender is taking on more risk by not having any collateral to fall back on.

Eligibility Criteria for Various Types of Loans

Personal Loans:

– Good credit score

– Stable income

– Low debt-to-income ratio

Mortgages:

– Good credit score

– Down payment

– Stable employment history

Auto Loans:

– Good credit score

– Proof of income

– Down payment

Credit Cards:

– Good credit score

– Income verification

– Credit history

These are just a few examples of the eligibility criteria for different types of loans. It’s important to research and understand the specific requirements for each type of loan before applying to increase your chances of approval.

Preparing for a Loan Application

Before diving into the loan application process, it’s crucial to prepare yourself financially. This step can significantly impact your chances of loan approval and the terms you may receive.

Understanding Credit Scores

Your credit score plays a vital role in the loan application process. Lenders use this score to assess your creditworthiness and determine the interest rate you’ll receive. A higher credit score typically results in better loan terms, while a lower score may lead to higher interest rates or even loan denial.

- Monitor your credit score regularly to stay informed about your financial standing.

- Pay your bills on time to avoid negative marks on your credit report.

- Keep your credit utilization low by not maxing out your credit cards.

Improving your credit score can take time, but the benefits of better loan terms are worth the effort.

Tips for Improving Credit Scores

Improving your credit score is a gradual process that requires discipline and strategic financial habits. Here are some tips to help boost your credit score:

- Pay off outstanding debts to lower your overall credit utilization ratio.

- Avoid opening multiple new credit accounts within a short period.

- Dispute any errors on your credit report promptly to ensure accurate information.

Completing the Loan Application

When completing a loan application, it is crucial to provide accurate and honest information to ensure the process goes smoothly and you have the best chance of approval.

Information Required in a Loan Application Form

- Your personal information: This includes your full name, address, contact details, social security number, and date of birth.

- Employment details: You will need to provide information about your current job, employer’s name, job title, and income.

- Financial information: This may include details about your assets, debts, and monthly expenses.

- Loan details: You will need to specify the loan amount you are requesting, the purpose of the loan, and the desired repayment term.

Common Questions in Loan Applications

- What is your annual income?

- Do you rent or own your home?

- Have you declared bankruptcy in the past 7 years?

- Do you have any other outstanding loans or debts?

Significance of Accuracy and Honesty

It is essential to be truthful and accurate when filling out a loan application because any false information can lead to your application being denied or even legal consequences. Lenders rely on the information provided to assess your creditworthiness and ability to repay the loan, so honesty is key in this process.

Submitting the Application

When it comes to submitting a loan application, borrowers have a few different methods at their disposal. Whether it’s online through a lender’s website, in-person at a physical branch, or even through the mail, there are various ways to get your application into the hands of the loan officer.

Submission Methods

- Online: Many lenders offer the convenience of applying for a loan online through their website. This allows borrowers to fill out the application at their own pace and submit it electronically.

- In-person: Some borrowers prefer the personal touch of meeting with a loan officer face-to-face and submitting their application in-person at a local branch or office.

- Mail: For those who prefer traditional methods, mailing in a paper application is still an option. However, this method may take longer to process compared to online or in-person submissions.

Timeline for Processing

After submitting a loan application, borrowers can typically expect to hear back from the lender within a few days to a few weeks. The exact timeline can vary depending on the lender, the type of loan, and the complexity of the application.

After Submission

- Verification: Once the application is submitted, the lender will begin the process of verifying the information provided. This may involve checking credit scores, income verification, and other supporting documents.

- Approval or Denial: After reviewing the application, the lender will make a decision to approve or deny the loan. If approved, the borrower will receive details about the loan terms and conditions.

- Closing: If the loan is approved, the final step involves closing the loan, signing the necessary paperwork, and receiving the funds.

Loan Approval and Disbursement

When it comes to getting approved for a loan and receiving the funds, there are several important factors and steps involved in the process.

Factors Influencing Loan Approval

- Credit Score: Lenders often consider your credit score to determine your creditworthiness and likelihood of repayment.

- Income and Employment History: Your income and stable employment history play a crucial role in the approval decision.

- Debt-to-Income Ratio: Lenders assess your debt-to-income ratio to ensure you can manage additional debt responsibly.

- Collateral: Secured loans require collateral, such as a home or car, which can influence the approval decision.

Verifying Information Provided

- Documentation: Lenders may request documents like pay stubs, tax returns, and bank statements to verify the information provided in the application.

- Credit Check: Lenders typically perform a credit check to confirm your credit history and assess your financial risk.

- Employment Verification: Lenders may contact your employer to verify your job status and income details.

Loan Disbursement Methods

- Direct Deposit: Funds can be directly deposited into your bank account for quick access.

- Check: Some lenders may issue a physical check that you can deposit into your account.

- Cash Pickup: In certain cases, you may be able to pick up cash from a local branch or designated location.