Diving into the world of debt repayment, we’ll explore the contrasting approaches of the debt avalanche and snowball method. Strap in for a ride filled with financial wisdom and practical tips, all delivered in a high school hip style that’s sure to keep you hooked.

As we unravel the intricacies of these two methods, you’ll gain a deeper understanding of how to tackle your debts head-on and pave the way to a debt-free future.

Definition of Debt Avalanche and Snowball Method

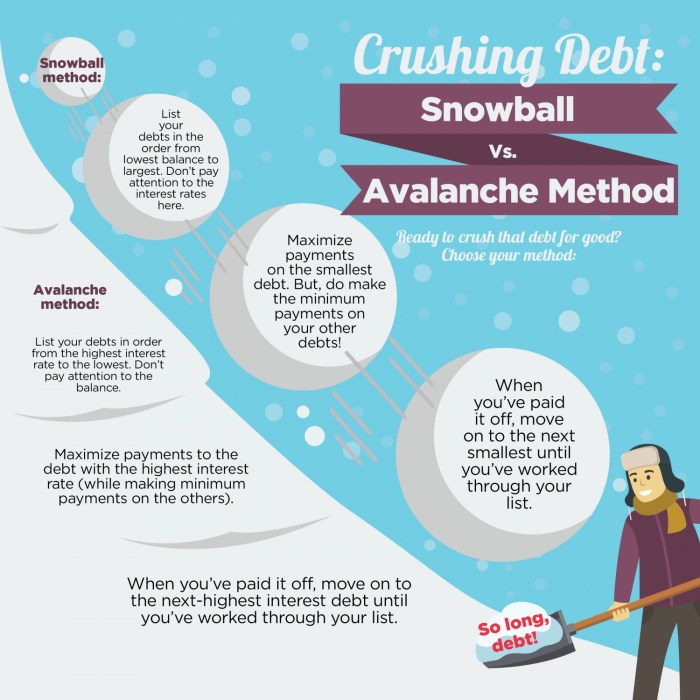

The debt avalanche method is a strategy for paying off debt that involves prioritizing debts with the highest interest rates first. By focusing on the highest interest debt while making minimum payments on the others, you can save money in the long run by reducing the amount of interest paid over time.

Debt Avalanche Method

In the debt avalanche method, you list your debts from highest to lowest interest rate. You then allocate extra funds towards the debt with the highest interest rate while making minimum payments on the rest. Once the first debt is paid off, you move on to the next highest interest rate debt, creating a snowball effect that accelerates debt repayment.

- Example: You have three debts – $5,000 at 18% interest, $3,000 at 15% interest, and $2,000 at 10% interest. Using the debt avalanche method, you would focus on paying off the $5,000 debt first, followed by the $3,000 debt, and finally the $2,000 debt.

Snowball Method

The snowball method is a debt repayment strategy that involves paying off the smallest debts first. By starting with the smallest debt, you can gain momentum and motivation as you see debts being eliminated one by one, creating a snowball effect that builds as you move on to larger debts.

- Example: Using the snowball method with the same three debts mentioned earlier, you would focus on paying off the $2,000 debt first, then the $3,000 debt, and finally the $5,000 debt. This method emphasizes quick wins and psychological motivation to keep you on track.

Comparison of Debt Avalanche and Snowball Method

When it comes to tackling debt, the debt avalanche and snowball methods are two popular strategies that can help you become debt-free. Let’s dive into the key differences between these two methods and explore the advantages of each.

Key Differences

- The debt avalanche method focuses on paying off debts with the highest interest rates first, while the snowball method prioritizes paying off debts with the smallest balances first.

- With the debt avalanche method, you may end up paying less in interest over time compared to the snowball method, as you are tackling high-interest debts first.

- On the other hand, the snowball method can provide a psychological boost by allowing you to see quick wins as you pay off smaller debts one by one.

Advantages of Debt Avalanche Method

- By targeting high-interest debts first, the debt avalanche method can save you money in the long run by reducing the amount of interest you pay.

- You may be able to pay off your debts faster with the debt avalanche method since you are focusing on the most costly debts upfront.

- Using the debt avalanche method can help you improve your credit score by reducing your overall debt burden and demonstrating responsible financial behavior.

Benefits of Snowball Method

- The snowball method can provide a sense of accomplishment and motivation as you pay off smaller debts quickly, building momentum to tackle larger debts.

- It can simplify your debt repayment strategy by allowing you to focus on one debt at a time, making it easier to track your progress.

- The snowball method can help you stay motivated and committed to your debt repayment plan by celebrating small victories along the way.

Implementing Debt Avalanche and Snowball Methods

When it comes to getting out of debt, implementing the debt avalanche and snowball methods can be game-changers. These strategies can help you pay off your debts faster and more efficiently, ultimately leading you to financial freedom.

Steps to Implement the Debt Avalanche Strategy

- List all your debts from the highest interest rate to the lowest.

- Make minimum payments on all debts except the one with the highest interest rate.

- Allocate extra funds to pay off the debt with the highest interest rate first.

- Once the first debt is paid off, move on to the next highest interest rate debt.

- Continue this process until all debts are paid off.

Process of Initiating the Snowball Method

- List all your debts from the smallest balance to the largest.

- Make minimum payments on all debts except the one with the smallest balance.

- Allocate extra funds to pay off the debt with the smallest balance first.

- Once the first debt is paid off, move on to the next smallest balance debt.

- Continue this process until all debts are paid off.

Tips for Maximizing the Effectiveness of Each Method

- Stay consistent and disciplined with your payments.

- Find ways to increase your income to accelerate debt payoff.

- Celebrate small victories along the way to stay motivated.

- Consider consolidating high-interest debts to lower rates.

- Automate your payments to avoid missing any deadlines.

Success Stories and Case Studies

When it comes to tackling debt, real-life success stories can provide inspiration and motivation for those looking to improve their financial situation. Here are some stories of individuals who successfully used the debt avalanche method to become debt-free:

Debt Avalanche Success Stories

- John, a software engineer, had accumulated credit card debt from multiple sources. By prioritizing his debts based on interest rates and using the debt avalanche method, he was able to pay off his highest interest debts first. This strategic approach saved him money on interest payments and allowed him to become debt-free in just three years.

- Sarah, a teacher, was struggling with student loan debt and high-interest personal loans. By focusing on paying off her debts with the highest interest rates first, she was able to make significant progress in reducing her overall debt burden. Through discipline and determination, Sarah became debt-free within five years.

On the other hand, the snowball method has also proven to be effective in helping individuals achieve financial freedom. Let’s take a look at some case studies where this method played a crucial role:

Snowball Method Case Studies

- Amy, a single mother, had accumulated debt from various sources, including credit cards and medical bills. Despite having debts with different interest rates, Amy decided to start with the smallest balance first using the snowball method. As she paid off each debt, she gained momentum and motivation to tackle larger balances. Thanks to the snowball method, Amy was able to eliminate her debt and achieve financial stability within six years.

- Mark, a recent college graduate, was burdened with student loan debt and a car loan. By following the snowball method and focusing on paying off his smallest debts first, Mark was able to quickly see progress in reducing his overall debt. This approach helped him stay motivated and on track towards becoming debt-free within four years.

These success stories highlight the importance of choosing the right debt repayment strategy based on individual financial situations. Whether it’s the debt avalanche method or the snowball method, tailoring these approaches to your specific needs and goals can help you effectively manage and eliminate debt.