Step into the world of investment risks and rewards, where the stakes are high and the rewards are even higher. Get ready for a rollercoaster ride through the financial markets as we explore the delicate balance between risk and reward.

Introduction to Investment Risks and Rewards

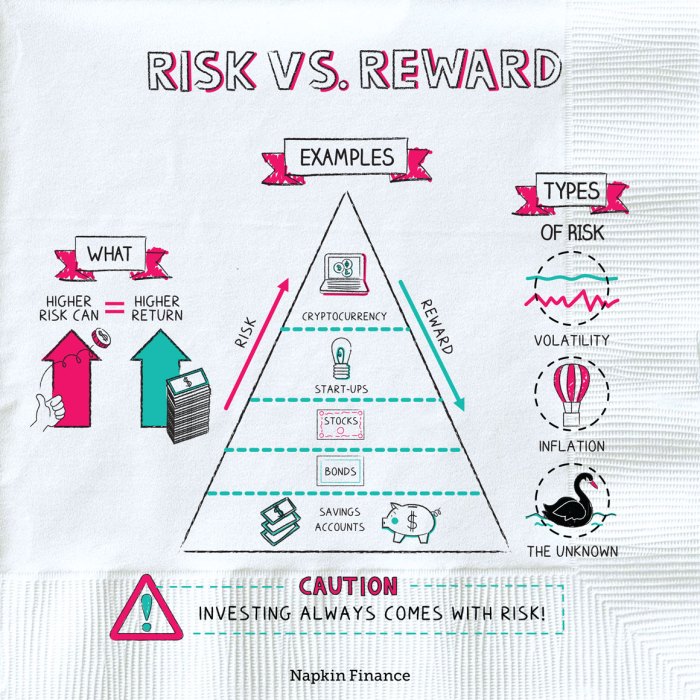

Investment risks and rewards are essential components of the financial markets. Risks refer to the possibility of losing money or not achieving the expected returns on an investment, while rewards represent the potential for gaining profits or achieving financial goals.

Understanding the balance between risks and rewards is crucial in making informed investment decisions. Investors need to assess the level of risk they are willing to take on in exchange for the potential rewards. It is important to consider factors such as investment goals, time horizon, and risk tolerance when evaluating investment opportunities.

Common Types of Investment Risks and Potential Rewards

- Market Risk: This type of risk is associated with the overall performance of the financial markets. Market fluctuations can impact the value of investments, leading to potential losses. However, investing in diversified assets can help mitigate market risk and potentially yield higher returns.

- Interest Rate Risk: Changes in interest rates can affect the value of fixed-income investments such as bonds. When interest rates rise, bond prices typically fall, resulting in potential losses for investors. On the other hand, investors may benefit from higher interest rates through increased returns on their investments.

- Business Risk: Business risk refers to the uncertainties related to a specific company’s operations and performance. Factors such as competition, regulatory changes, and management decisions can impact the financial health of a company and, consequently, affect the value of its stock. However, successful investments in individual stocks can yield substantial rewards if the company performs well.

Types of Investment Risks

Investing always comes with risks, and understanding the different types of investment risks is crucial for managing your portfolio effectively. Let’s take a closer look at some common categories of investment risks and how they can impact your investments.

Market Risk

Market risk refers to the possibility of financial loss due to changes in the market conditions. This type of risk is associated with the overall performance of the financial markets, including factors like economic conditions, interest rates, and geopolitical events. For example, if there is a sudden economic downturn, the value of your investments may decrease significantly.

Credit Risk

Credit risk is the risk of loss from a borrower failing to repay a loan or meet their debt obligations. This risk is prevalent in bonds and other fixed-income securities where the issuer may default on payments. An example of credit risk is when a company you have invested in goes bankrupt, leading to a loss in your investment.

Inflation Risk

Inflation risk is the risk that the purchasing power of your money will decrease over time due to rising inflation rates. Inflation erodes the real value of your investments, especially fixed-income securities. For instance, if the inflation rate exceeds the return on your investments, your purchasing power will decrease.

Interest Rate Risk

Interest rate risk refers to the impact of changing interest rates on the value of fixed-income securities. When interest rates rise, bond prices tend to fall, leading to a decrease in the value of your investments. Conversely, when interest rates decrease, bond prices may rise, affecting your investment returns.

Liquidity Risk

Liquidity risk is the risk of not being able to sell an investment quickly without significantly affecting its price. Investments with low liquidity may be challenging to sell at a fair price, especially during market downturns. This risk can result in losses if you need to sell your investments urgently.

Assessing Investment Risks

When it comes to investing, understanding and assessing risks is crucial for making informed decisions. By evaluating the potential risks associated with an investment, investors can better protect their capital and potentially increase their returns.

Methods to Assess and Measure Investment Risks

- One common method used to assess investment risks is through historical data analysis. By looking at how an asset has performed in the past, investors can get a sense of its volatility and potential risks.

- Another approach is conducting fundamental analysis, which involves evaluating the financial health and performance of a company or asset. This can help investors gauge the risks associated with the investment.

- Risk assessment tools and models, such as Value at Risk (VaR) or Monte Carlo simulations, can also be used to quantify and measure potential risks in an investment portfolio.

Role of Diversification in Managing Investment Risks

Diversification plays a critical role in managing investment risks by spreading capital across different asset classes, industries, and geographic regions. By diversifying their portfolios, investors can reduce the impact of any single investment’s performance on their overall returns. This strategy helps mitigate risks associated with market fluctuations and specific asset failures.

Mitigating Risks Through Various Strategies

- Setting stop-loss orders to limit potential losses on investments.

- Regularly reviewing and rebalancing investment portfolios to maintain diversification.

- Using hedging instruments, such as options or futures contracts, to protect against downside risks.

- Implementing a long-term investment strategy to weather short-term market volatility.

Potential Investment Rewards

Investing in different vehicles like stocks, bonds, real estate, and other assets comes with the potential for various rewards. These rewards can include capital gains, dividends, interest income, rental income, and overall portfolio growth. The key is to understand how factors such as time horizon and risk tolerance can impact the potential rewards of your investments.

Impact of Time Horizon and Risk Tolerance

The time horizon refers to the length of time you plan to hold an investment before needing to access the funds. A longer time horizon allows for more significant growth potential as investments have more time to compound returns. On the other hand, risk tolerance determines how much volatility or fluctuation in value you can handle. Higher risk tolerance may lead to potentially higher returns but also increases the likelihood of losses.

- For example, investors with a long time horizon and high risk tolerance may choose to invest heavily in stocks, which historically offer higher returns but come with higher volatility.

- Conversely, investors with a shorter time horizon or lower risk tolerance might opt for more stable investments like bonds or real estate investment trusts (REITs) that provide steady income streams.

- Diversification across different asset classes can help balance risk and potential rewards, ensuring a more stable portfolio overall.

Successful Investment Strategies

Successful investors often follow specific strategies that have led to significant rewards over time. Some common strategies include:

- Buy and hold: This strategy involves purchasing assets and holding onto them for an extended period, allowing them to appreciate over time.

- Value investing: Investors look for undervalued assets with the potential for long-term growth, aiming to buy low and sell high.

- Dividend investing: Focusing on companies that pay regular dividends can provide a steady income stream in addition to potential capital appreciation.

- Growth investing: Investing in companies with high growth potential can lead to significant returns, although it comes with higher risk.

Balancing Risks and Rewards

When it comes to investing, the concept of risk-return tradeoff plays a crucial role in making investment decisions. Investors need to carefully consider the level of risk they are willing to take on in exchange for potential rewards.

Striking a Balance Between Risks and Rewards

Creating a well-rounded investment portfolio involves striking a balance between taking risks and seeking rewards. Here are some tips on how investors can achieve this:

- Diversify your investments: By spreading your investments across different asset classes, industries, and geographical regions, you can reduce the overall risk in your portfolio.

- Consider your risk tolerance: Understand your own risk tolerance and investment goals to ensure that you are comfortable with the level of risk you are taking on.

- Rebalance your portfolio: Regularly review and rebalance your portfolio to ensure that it aligns with your risk tolerance and investment objectives.

- Seek professional advice: Consult with a financial advisor to get expert guidance on creating a well-balanced investment portfolio that suits your individual needs.