With how to invest in gold at the forefront, this paragraph opens a window to an amazing start and intrigue, inviting readers to embark on a storytelling journey filled with unexpected twists and insights. Gold has always held a special allure as an investment, with its timeless value and stability. In this guide, we will dive into the world of gold investment, exploring its historical significance, various investment methods, factors influencing prices, and effective strategies to maximize returns. Get ready to unlock the secrets of investing in gold and watch your wealth grow!

The content of the second paragraph that provides descriptive and clear information about the topic

Introduction to Investing in Gold

Investing in gold has been a popular choice for many investors due to its historical significance and stability as an asset. Gold has long been considered a safe haven during times of economic uncertainty, making it a valuable addition to any investment portfolio.

Significance of Gold as an Investment

Gold has been used as a form of currency and store of value for centuries, with its intrinsic value and limited supply contributing to its appeal as an investment. Unlike fiat currencies, which can be devalued by inflation or economic instability, gold has maintained its value over time.

Historical Performance of Gold

Throughout history, gold has shown resilience in times of economic crisis, often increasing in value when other assets falter. For example, during the 2008 financial crisis, the price of gold surged as investors sought a safe haven from market volatility.

Comparison to Other Traditional Investment Options

- Stocks: Gold is often seen as a hedge against stock market volatility, with its price movements often moving inversely to that of stocks.

- Bonds: While bonds offer fixed income, they can be impacted by interest rate changes and inflation. Gold, on the other hand, is not tied to any specific interest rates or government policies.

- Real Estate: Both gold and real estate are tangible assets, but gold offers more liquidity and can be easily traded on the open market.

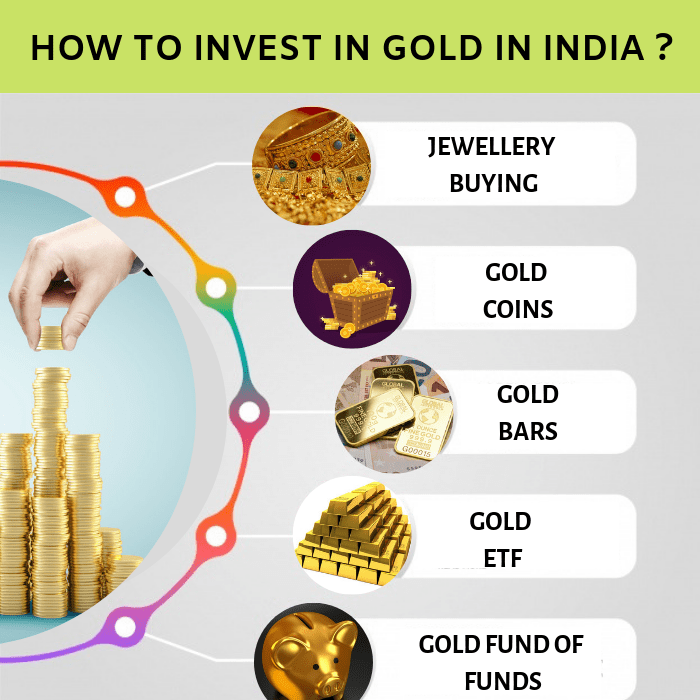

Ways to Invest in Gold

Investing in gold can be done through various methods, each with its own set of benefits and risks. Here’s an overview of different ways to invest in gold:

Physical Gold

Investors can choose to buy physical gold in the form of gold coins or bars. Gold coins are minted by government mints and are easily recognizable and tradable. On the other hand, gold bars are typically produced by private mints and are available in various sizes, making them a convenient option for investors looking to invest in larger quantities of gold.

- Buying physical gold provides investors with a tangible asset that they can hold onto.

- Physical gold can act as a hedge against inflation and economic uncertainty.

- However, storing and insuring physical gold can be costly and pose security risks.

Gold ETFs

Gold Exchange-Traded Funds (ETFs) are investment funds that track the price of gold and are traded on stock exchanges. Investors can buy and sell shares of gold ETFs, providing them with exposure to the price movements of gold without actually owning physical gold.

- Investing in gold ETFs offers liquidity and ease of trading.

- Gold ETFs are a cost-effective way to invest in gold without the need for storage or insurance.

- However, investors do not have direct ownership of physical gold when investing in gold ETFs.

Gold Mining Stocks

Investing in gold mining stocks involves buying shares of companies that are involved in gold mining and production. The value of these stocks is influenced by the performance of the company, as well as the price of gold in the market.

- Gold mining stocks can provide investors with exposure to the gold industry and potential dividends.

- Investing in gold mining stocks allows for diversification within the mining sector.

- However, the value of gold mining stocks can be volatile and is subject to company-specific risks.

Factors Influencing Gold Prices

In the world of investing, gold prices are influenced by a variety of factors that can cause fluctuations in its value. Understanding these key factors is essential for anyone looking to invest in gold.

Interest Rates:

One of the most significant factors affecting the price of gold is interest rates set by central banks. When interest rates are low, the opportunity cost of holding gold decreases, making it more attractive to investors. Conversely, when interest rates are high, the opportunity cost of holding gold increases, leading to a decrease in demand and a potential drop in gold prices.

Inflation:

Inflation is another important factor that impacts the price of gold. Historically, gold has been seen as a hedge against inflation, as its value tends to increase during times of rising prices. Investors often turn to gold as a store of value when inflation erodes the purchasing power of fiat currencies.

Geopolitical Events:

Geopolitical events such as wars, political instability, and trade disputes can have a significant impact on gold prices. During times of uncertainty, investors tend to flock to safe-haven assets like gold, driving up its price. Global events that disrupt markets or threaten economic stability can lead to increased demand for gold as a perceived safe haven.

Economic Indicators:

Various economic indicators, such as GDP growth, unemployment rates, and consumer sentiment, can also influence the price of gold. For example, a strong economic performance may lead to higher interest rates, which can in turn impact the price of gold. Additionally, economic indicators that signal potential inflation or deflation can impact investor sentiment and drive changes in gold prices.

Correlation with Other Asset Classes:

Gold prices often exhibit correlations with other asset classes, such as stocks, bonds, and commodities. Understanding these relationships can help investors diversify their portfolios and manage risk. For example, gold tends to have a negative correlation with stocks, meaning that when stock prices fall, gold prices may rise as investors seek safe-haven assets.

Overall, keeping an eye on these key factors and understanding how they influence gold prices can help investors make informed decisions when it comes to investing in this precious metal.

Gold Investment Strategies

Investing in gold offers various strategies for investors to consider based on their financial goals and risk tolerance. Understanding different approaches can help individuals make informed decisions to maximize returns and minimize risks.

Long-Term Holding

- Long-term holding involves purchasing gold with the intention of holding onto it for an extended period, typically years or even decades.

- This strategy is suitable for investors looking to hedge against inflation, economic uncertainty, or currency devaluation.

- By holding onto gold over the long term, investors can benefit from potential price appreciation and store of value properties.

Trading

- Trading gold involves buying and selling the precious metal within shorter time frames, such as days, weeks, or months.

- Traders aim to profit from price fluctuations in the gold market by speculating on short-term price movements.

- This strategy requires active monitoring of the market and may involve higher risks due to volatility.

Diversification

- Diversification involves including gold investments in a portfolio alongside other asset classes, such as stocks, bonds, and real estate.

- By diversifying with gold, investors can reduce overall portfolio risk and enhance returns through exposure to different market conditions.

- Gold’s low correlation with other assets makes it an effective diversification tool to cushion against market downturns.

Successful Gold Investment Strategies

Successful gold investment strategies often involve a combination of long-term holding, trading, and diversification tailored to individual risk profiles and financial objectives. For example, a conservative investor may opt for long-term holding to preserve wealth, while a more aggressive investor might engage in trading to capitalize on short-term price movements.

Creating a Balanced Portfolio with Gold Investments

Adding gold to a portfolio can enhance diversification and reduce overall risk exposure. Investors can achieve a balanced portfolio by allocating a portion of their assets to gold based on their risk tolerance and investment horizon. By combining different gold investment strategies with other asset classes, individuals can build a resilient portfolio that withstands market fluctuations and delivers long-term growth potential.