As fixed vs variable loan rates takes center stage, this opening passage beckons readers with american high school hip style into a world crafted with good knowledge, ensuring a reading experience that is both absorbing and distinctly original.

When it comes to managing your finances, understanding the difference between fixed and variable loan rates is crucial. Let’s dive into the details and explore the pros and cons of each option.

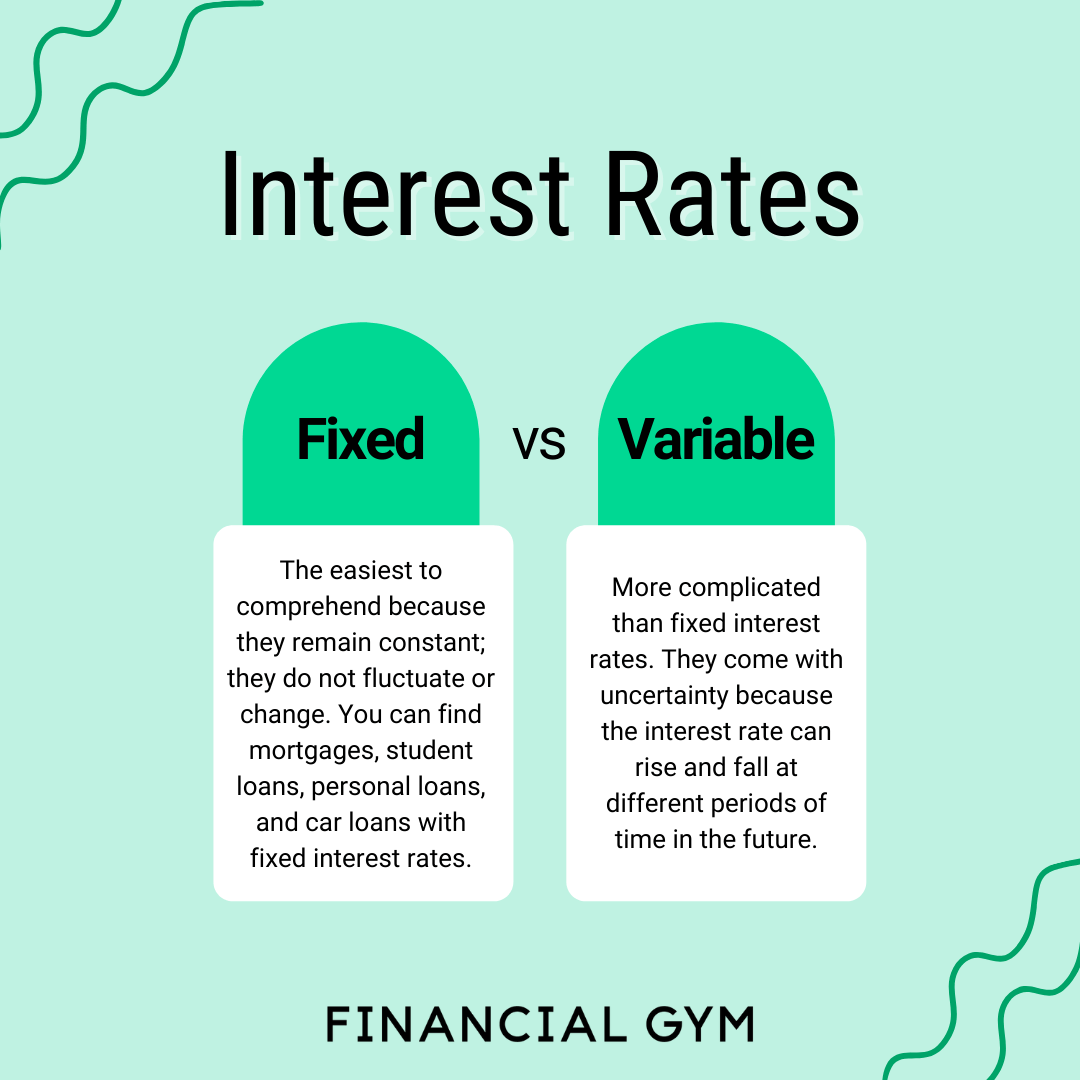

Fixed vs Variable Loan Rates

When it comes to borrowing money through loans, there are two main types of interest rates that lenders offer: fixed and variable rates. Each type has its own set of characteristics, advantages, and drawbacks that borrowers need to consider before making a decision.

Fixed Interest Rates

Fixed interest rates remain the same throughout the entire term of the loan. This means that the interest rate you agree upon when you take out the loan will not change, regardless of fluctuations in the market. This provides borrowers with predictability and stability in their monthly payments.

- Pros:

- Stable monthly payments

- Predictable interest costs

- Protection against interest rate hikes

- Cons:

- May be higher initially compared to variable rates

- No benefit if market rates decrease

Example: A fixed rate mortgage might be more suitable for someone who values stability and wants to know exactly how much they will need to pay each month without worrying about potential rate increases.

Variable Interest Rates

Variable interest rates, on the other hand, can fluctuate over time based on changes in the market interest rates. This means that your monthly payments could go up or down, depending on how the market behaves. Variable rates are typically lower than fixed rates initially.

- Pros:

- Potential for lower initial rates

- Chance to benefit from rate decreases

- Cons:

- Uncertainty in monthly payments

- Exposure to interest rate hikes

Example: A variable rate loan might be more suitable for someone who is comfortable with some level of risk and is willing to take advantage of potential rate decreases in the market.

Factors Influencing Loan Rate Choices

When choosing between fixed and variable loan rates, there are several economic factors that borrowers need to consider. These factors can have a significant impact on the overall cost of borrowing and the stability of loan repayments.

Economic Factors Affecting Fixed Loan Rates

Fixed loan rates are influenced by various economic factors, including:

- Economic Conditions: Stability in the economy can lead to lower fixed loan rates as lenders perceive lower risk.

- Interest Rate Trends: Fixed loan rates are closely tied to long-term interest rates, which can be affected by central bank policies and market conditions.

- Inflation Expectations: Lenders factor in inflation expectations when setting fixed loan rates to ensure they maintain their purchasing power over time.

Market Conditions Impacting Variable Loan Rates

Variable loan rates are more susceptible to market conditions such as:

- Interest Rate Fluctuations: Variable loan rates are directly linked to short-term interest rates, which can change frequently based on economic indicators and central bank decisions.

- Economic Indicators: Market conditions, such as employment rates and GDP growth, can impact variable loan rates as lenders assess the overall health of the economy.

Role of Inflation in Choosing Fixed vs Variable Rates

Inflation plays a crucial role in determining the attractiveness of fixed versus variable loan rates. When inflation is expected to rise, borrowers may opt for fixed rates to lock in a lower rate and protect against future increases. Conversely, in a low inflation environment, variable rates may be more appealing as they can adjust to market conditions.

External Factors Influencing Loan Rate Decisions

External factors, such as geopolitical events or natural disasters, can also influence loan rate decisions. For example, a global economic downturn may lead to lower fixed rates as central banks implement stimulus measures to boost the economy. On the other hand, political instability can cause variable rates to increase due to heightened market volatility.

Risk Assessment

In the realm of loan rates, understanding the risks involved is crucial for making informed decisions. Let’s delve into how fixed and variable rates differ in terms of risk assessment.

Stability of Repayment Amounts with Fixed Rates

Fixed rates offer borrowers the advantage of predictability and stability in their repayment amounts. This means that regardless of any fluctuations in the market, your monthly payments remain constant throughout the life of the loan.

Risks of Interest Rate Hikes in Variable Rate Loans

On the other hand, variable rate loans are exposed to the risk of potential interest rate hikes. This means that your monthly payments could increase if the market interest rates rise, leading to uncertainty and higher repayment amounts.

Strategies for Mitigating Risks

- Diversify your portfolio: Spread your investments across different assets to minimize the impact of interest rate fluctuations.

- Monitor the market: Stay informed about economic trends and interest rate movements to anticipate potential changes.

- Consider refinancing: If interest rates rise significantly, explore the option of refinancing your loan to secure a better rate.

Comparison of Risk Profiles

Fixed rate loans provide stability but may come with slightly higher initial rates, while variable rate loans offer lower initial rates but carry the risk of increasing payments. The choice between the two depends on your risk tolerance, financial goals, and market outlook.

Consumer Considerations

When it comes to choosing between fixed and variable loan rates, consumers need to carefully evaluate their options based on their individual circumstances. Factors such as personal financial goals, timelines, and risk tolerance play a crucial role in making an informed decision.

Personal Financial Goals and Timelines Influence

- Consider your long-term financial goals: If you prefer stability and predictability in your budget, a fixed rate might be more suitable. On the other hand, if you are comfortable with fluctuations and can adapt to changing interest rates, a variable rate could be an option.

- Assess your financial timeline: Think about how long you plan to keep the loan. If you intend to pay off the loan quickly, a variable rate may offer initial cost savings. However, if you anticipate holding the loan for an extended period, a fixed rate can provide protection against interest rate hikes.

Tips for Informed Decision-Making

- Educate yourself on the pros and cons: Understand the benefits and risks associated with fixed and variable rates to make a well-informed decision.

- Consult with a financial advisor: Seek guidance from a professional who can provide personalized advice based on your financial situation and goals.

- Consider a hybrid option: Some borrowers opt for a combination of fixed and variable rates to hedge against interest rate fluctuations while maintaining some level of predictability.

Impact of Loan Term Length

- Short-term vs. long-term loans: The length of the loan term can influence the choice between fixed and variable rates. Short-term loans may be less impacted by interest rate fluctuations, making variable rates a viable option. In contrast, long-term loans benefit from the stability of fixed rates, protecting borrowers from potential rate increases over time.