Diving into the world of credit scores, get ready for a wild ride as we explore the ins and outs of this crucial financial factor. From loan approvals to personal finance impacts, we’ve got you covered with all the juicy details.

Get ready to level up your credit score knowledge with our detailed breakdown of key factors and range implications.

Importance of Credit Scores

Having a good credit score is crucial when it comes to making financial decisions. Your credit score reflects your creditworthiness and is used by lenders to determine if they should approve your loan application and what interest rate to offer you.

Credit Scores Impact Loan Approvals and Interest Rates

- Lenders typically prefer to work with individuals who have higher credit scores as they are considered less risky borrowers.

- Higher credit scores can lead to faster loan approvals and lower interest rates, saving you money in the long run.

- On the other hand, lower credit scores may result in loan denials or higher interest rates, making borrowing more expensive.

Credit Scores Affect Various Aspects of Personal Finance

- Insurance premiums: Some insurance companies use credit scores to determine premiums for auto or home insurance.

- Apartment rentals: Landlords may check credit scores to assess the financial responsibility of potential tenants.

- Employment opportunities: Some employers may review credit scores as part of the hiring process, especially for positions involving financial responsibilities.

Factors Affecting Credit Scores

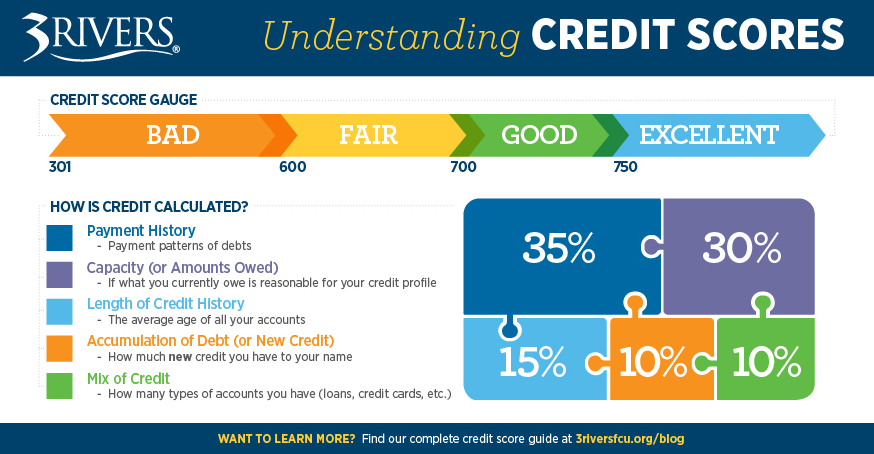

When it comes to credit scores, several factors play a significant role in determining an individual’s creditworthiness. Understanding these factors is crucial for maintaining a healthy credit score.

Payment History

Your payment history is one of the most critical factors that influence your credit score. It reflects how timely you have been in paying your bills, including credit card payments, loan installments, and other debts. A history of on-time payments can significantly boost your credit score, while late payments or defaults can have a negative impact.

Credit Utilization

Credit utilization refers to the amount of credit you are currently using compared to the total credit available to you. High credit utilization ratios can signal financial distress and may lower your credit score. It is generally recommended to keep your credit utilization below 30% to maintain a good credit score.

Credit Inquiries

When you apply for new credit, lenders usually perform a hard inquiry on your credit report. Multiple hard inquiries within a short period can indicate that you are taking on more debt than you can handle, leading to a drop in your credit score. It is essential to be strategic about applying for new credit to avoid unnecessary inquiries.

Types of Credit

Having a mix of different types of credit accounts, such as credit cards, installment loans, and mortgages, can positively impact your credit score. Lenders like to see that you can manage various types of credit responsibly. However, having too many accounts of the same type may not necessarily improve your credit score.

Weight of Factors

While all the factors mentioned above are essential, their weight in determining your credit score may vary. Payment history and credit utilization typically carry the most significant weight, followed by credit inquiries and types of credit. Understanding the importance of each factor can help you make informed financial decisions to maintain or improve your credit score.

Understanding Credit Score Range

Credit scores typically range from poor to excellent, with each range impacting borrowing and financial opportunities differently. It is crucial to understand the implications of these ranges and how to improve credit scores within each category.

Poor Credit Score Range

A poor credit score is usually below 580, making it challenging to qualify for loans or credit cards. Lenders may see you as high-risk, leading to higher interest rates or rejection of credit applications.

- Actions to improve: Pay bills on time, reduce outstanding debt, and check for errors on your credit report.

Fair Credit Score Range

A fair credit score falls between 580 and 669. While you may qualify for credit, you may still face higher interest rates and stricter terms compared to those with good or excellent credit.

- Actions to improve: Use credit responsibly, keep credit card balances low, and limit new credit applications.

Good Credit Score Range

A good credit score ranges from 670 to 739. This score allows you to qualify for better terms and lower interest rates on loans and credit cards.

- Actions to improve: Maintain low credit card balances, diversify your credit mix, and avoid closing old accounts.

Excellent Credit Score Range

An excellent credit score is typically above 740. Individuals with excellent credit scores have access to the best loan terms, lowest interest rates, and highest credit limits.

- Actions to improve: Continue practicing good credit habits, such as paying bills in full and on time, and monitoring your credit regularly.

Building and Maintaining Good Credit

Building and maintaining good credit is essential for financial health and stability. It allows for easier access to loans, better interest rates, and more opportunities for financial growth. Here are some strategies to help you build credit from scratch and maintain a good credit score over time.

Building Credit from Scratch

- Open a secured credit card: A secured credit card requires a cash deposit as collateral, making it easier to get approved even with no credit history.

- Become an authorized user: Ask a family member or friend with good credit to add you as an authorized user on their credit card. Your credit activity on that card can help build your credit.

- Apply for a credit builder loan: These loans are designed to help you establish credit by making small monthly payments that are reported to credit bureaus.

Maintaining a Good Credit Score Over Time

- Pay your bills on time: Payment history has a significant impact on your credit score. Make sure to pay all your bills by the due date to avoid negative marks on your credit report.

- Keep your credit utilization low: Aim to use no more than 30% of your available credit to show lenders that you can manage credit responsibly.

- Monitor your credit report regularly: Check your credit report for errors or signs of identity theft. Reporting and fixing inaccuracies can help maintain a good credit score.

Responsibly Managing Credit

- Avoid opening multiple new accounts at once: Opening several accounts in a short period can lower the average age of your credit history and impact your score negatively.

- Don’t close old accounts: Keeping old accounts open can help increase the average age of your credit history, which can positively impact your score.

- Use credit wisely: Only borrow what you can afford to repay and avoid maxing out your credit cards. Responsible credit use is key to building and maintaining good credit.

Credit Score Myths vs. Facts

In the world of credit scores, there are many myths that can lead individuals astray when it comes to understanding their financial health. Let’s debunk some common misconceptions and set the record straight with factual information.

Myth: Checking Your Credit Score Will Lower It

Contrary to popular belief, checking your own credit score is considered a “soft inquiry” and does not have any impact on your score. It’s important to regularly monitor your credit score to stay informed about your financial standing without fear of lowering it.

Myth: Closing Credit Card Accounts Improves Your Credit Score

Some may think that closing old or unused credit card accounts can boost their credit score. However, closing accounts can actually harm your score by reducing the overall amount of credit available to you. It’s better to keep accounts open and maintain a low balance to improve your credit utilization ratio.

Myth: You Need to Carry a Balance on Your Credit Cards to Build Credit

Carrying a balance on your credit cards does not directly impact your credit score. In fact, it’s recommended to pay off your credit card balances in full each month to avoid accruing interest. Responsible credit card use, such as making timely payments and keeping balances low, is what helps build a positive credit history.

Myth: Closing a Negative Account Will Remove It from Your Credit Report

Closing a negative account, such as one with late payments or collections, does not erase it from your credit report. Negative information can stay on your report for up to seven years, impacting your credit score. It’s best to work on improving your credit habits to lessen the impact of negative marks over time.

Myth: Income Level Affects Your Credit Score

Your income level is not a factor in calculating your credit score. While creditors may consider your income when determining your creditworthiness for a loan, it does not directly impact your credit score. Factors like payment history, credit utilization, length of credit history, types of credit, and new credit inquiries are what influence your credit score.