Yo, peep this – Financial regulations in the U.S. are like the cool cats keeping the financial world in check. From banking rules to securities regulations, it’s a wild ride full of twists and turns. Get ready to dive into this groove with me!

Let’s break down the different types of regulations, how they’ve evolved over time, and the nitty-gritty of compliance and enforcement. Stay tuned for the lowdown!

Overview of Financial Regulations in the U.S.

Financial regulations in the U.S. have a rich history dating back to the early days of the country. The need for regulations became more prominent after the Great Depression in the 1930s, leading to the establishment of key regulatory bodies to oversee the financial sector.

Brief History of Financial Regulations

Financial regulations in the U.S. have evolved over time in response to various financial crises and market challenges. The Securities Act of 1933 and the Securities Exchange Act of 1934 were among the first major regulations put in place to restore confidence in the financial markets after the Great Depression.

Importance of Financial Regulations

Financial regulations play a crucial role in ensuring stability and transparency in the financial sector. By setting rules and standards for financial institutions, regulators help protect investors, maintain market integrity, and prevent systemic risks that could lead to another financial crisis.

Key Regulatory Bodies

- The Securities and Exchange Commission (SEC): Responsible for enforcing federal securities laws and regulating the securities industry.

- The Federal Reserve: Oversees monetary policy, bank regulation, and financial stability in the U.S.

- The Commodity Futures Trading Commission (CFTC): Regulates the commodity futures and options markets to prevent fraud and manipulation.

- The Financial Industry Regulatory Authority (FINRA): Regulates brokerage firms and exchange markets to protect investors and ensure market integrity.

Types of Financial Regulations

Financial regulations in the U.S. encompass a variety of rules and guidelines that govern different aspects of the financial industry, including banking, securities, and consumer protection.

Banking Regulations

- The Federal Reserve Act of 1913 – Established the Federal Reserve System to regulate the country’s banking system.

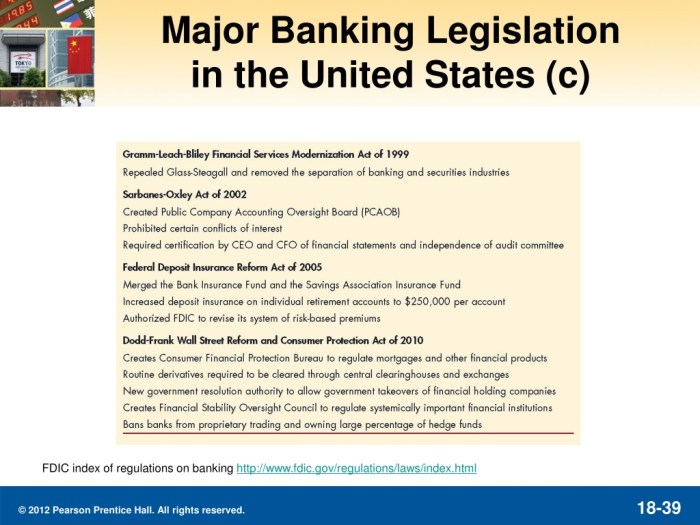

- The Dodd-Frank Wall Street Reform and Consumer Protection Act – Implemented after the 2008 financial crisis to enhance supervision and regulation of financial institutions.

Securities Regulations

- The Securities Act of 1933 – Requires companies to disclose certain information to investors before offering securities for sale.

- The Securities Exchange Act of 1934 – Regulates the secondary trading of securities, ensuring transparency and fairness in the markets.

Consumer Protection Regulations

- The Truth in Lending Act – Requires lenders to disclose key terms and costs of credit agreements to consumers.

- The Fair Credit Reporting Act – Regulates the collection and use of consumer credit information.

Evolution of Financial Regulations

Financial regulations in the U.S. have undergone significant changes over time in response to shifting economic landscapes. These changes have been influenced by various events and crises that have shaped the regulatory framework.

The Great Depression

One of the most significant events that led to the implementation of new financial regulations was the Great Depression in the 1930s. The stock market crash of 1929 and the subsequent economic downturn highlighted the need for stricter oversight and regulations to prevent such a catastrophic event from happening again.

- The Glass-Steagall Act of 1933 was passed to separate commercial and investment banking activities, reducing the risk of speculative investments.

- The Securities Act of 1933 and the Securities Exchange Act of 1934 were enacted to regulate the issuance and trading of securities, aiming to protect investors from fraud and manipulation.

The 2008 Financial Crisis

The 2008 financial crisis, triggered by the collapse of the housing market bubble and risky lending practices, exposed weaknesses in the regulatory framework. This crisis led to the implementation of new regulations to address systemic risks and enhance financial stability.

- The Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 introduced significant reforms, such as the creation of the Consumer Financial Protection Bureau and the Volcker Rule to restrict banks from engaging in risky proprietary trading.

- Stress tests and capital requirements were strengthened to ensure that financial institutions have enough capital to withstand economic downturns.

Current Challenges

Despite the efforts to strengthen financial regulations, challenges remain in addressing modern financial complexities. Rapid technological advancements, globalization, and evolving market practices present new challenges that regulators need to adapt to.

The rise of cryptocurrencies and digital assets has raised questions about how to regulate these new forms of financial instruments effectively.

Financial innovation and the interconnectedness of global markets require a more coordinated regulatory approach to prevent systemic risks.

Compliance and Enforcement

In order to ensure financial institutions adhere to the established regulations, compliance plays a crucial role in the financial sector. Let’s delve into the process of compliance with financial regulations and the enforcement mechanisms in place.

Compliance Process for Financial Institutions

- Financial institutions are required to conduct regular audits and assessments to ensure they are following all relevant financial regulations.

- They must maintain detailed records of their financial activities and transactions to demonstrate compliance when required.

- Training programs for employees are essential to keep them informed about the latest regulations and compliance requirements.

- Regular reporting to regulatory bodies is necessary to provide transparency and accountability in their operations.

Role of Regulatory Bodies in Enforcement

- Regulatory bodies such as the Securities and Exchange Commission (SEC) and the Federal Reserve play a critical role in enforcing compliance with financial regulations.

- These bodies have the authority to conduct investigations, impose fines, and even revoke licenses of institutions found to be non-compliant.

- They work closely with law enforcement agencies to ensure that violations are addressed promptly and effectively.

- Regular inspections and audits are conducted by regulatory bodies to monitor the activities of financial institutions and enforce compliance.

Notable Cases of Regulatory Actions

- In 2008, the SEC charged investment bank Goldman Sachs with fraud for misleading investors about a complex financial product, resulting in a $550 million settlement.

- Wells Fargo faced regulatory actions in 2016 for opening millions of unauthorized accounts, leading to a $185 million penalty by the Consumer Financial Protection Bureau.

- JPMorgan Chase was fined $920 million in 2013 for the “London Whale” trading scandal, where traders made risky bets resulting in massive losses.

- Citibank was fined $400 million in 2012 for manipulating the LIBOR interest rate, impacting global financial markets.