Diving into the world of finance and mental health, we’re about to take you on a journey that’s as cool as your favorite high school hangout spot. From the impact of financial stress on your mental well-being to strategies for managing financial anxiety, get ready for some real talk that’s gonna make you think, “Why didn’t they teach us this in school?”

Let’s break it down and uncover the secrets to achieving financial peace of mind while keeping your mental health in check. So grab your backpack, because we’re about to drop some knowledge bombs that’ll have you feeling like the coolest kid in class.

Impact of Financial Stress on Mental Health

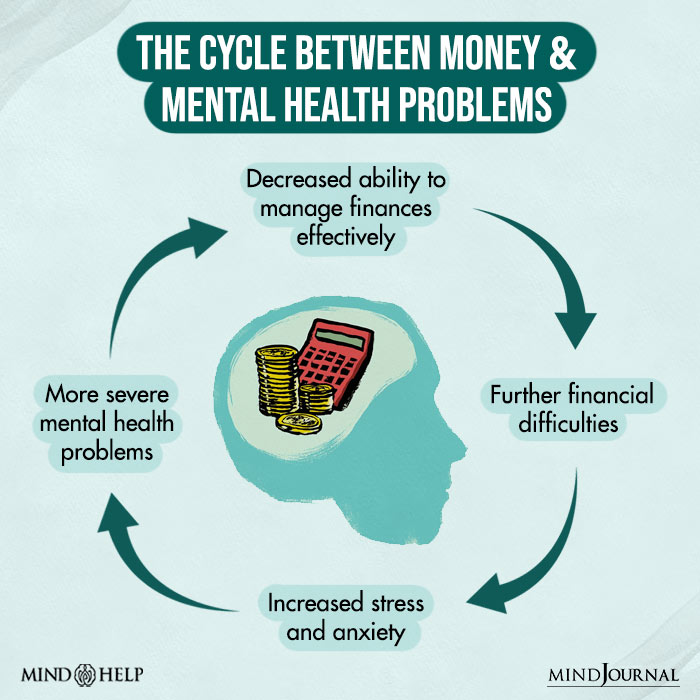

Financial stress can have a significant impact on an individual’s mental health. When someone is dealing with financial struggles, it can lead to feelings of anxiety, depression, and overall decreased well-being. The constant worry about money, inability to meet financial obligations, and fear of the future can take a toll on mental health.

Examples of How Financial Struggles Contribute to Anxiety and Depression

- Constant worrying about paying bills and meeting expenses can lead to heightened anxiety levels.

- Feeling overwhelmed by debt and financial responsibilities can contribute to feelings of hopelessness and depression.

- The pressure to maintain a certain lifestyle or keep up with others financially can create a sense of inadequacy and low self-esteem.

Relationship Between Financial Insecurity and Overall Well-being

Financial insecurity can negatively impact overall well-being in various ways:

- Increased stress levels can lead to physical health issues such as high blood pressure and heart problems.

- Strained relationships with family and friends due to financial stress can result in feelings of isolation and loneliness.

- Lack of access to resources for self-care and relaxation can further exacerbate mental health issues.

Strategies for Managing Financial Anxiety

Financial anxiety can be overwhelming, but there are strategies to help you cope and regain control of your mental well-being. By implementing these tips, you can work towards a healthier relationship with your finances and reduce stress.

Budgeting

Budgeting is a key strategy for managing financial anxiety. Creating a budget allows you to track your expenses, prioritize your spending, and identify areas where you can cut back. By having a clear understanding of your financial situation, you can alleviate some of the uncertainty and anxiety surrounding money.

Seeking Financial Advice

Seeking financial advice from professionals can provide you with valuable insights and guidance on how to improve your financial health. Financial advisors can help you create a personalized financial plan, set financial goals, and make informed decisions about investments and savings. Their expertise can give you peace of mind and reduce financial stress.

Building an Emergency Fund

Building an emergency fund is another effective way to manage financial anxiety. Having a financial safety net can help you feel more secure and prepared for unexpected expenses or emergencies. By setting aside a portion of your income regularly, you can build up savings that can provide a buffer during challenging times.

Importance of Seeking Professional Help

It is important to recognize when financial anxiety is impacting your mental health and seek professional help. Therapists and counselors can provide support and strategies to cope with stress, anxiety, and other mental health concerns related to finances. Don’t hesitate to reach out for help when you need it.

Role of Financial Education in Mental Health

Financial education plays a crucial role in improving mental health by reducing financial stress and anxiety. When individuals have a better understanding of financial concepts and are equipped with the necessary skills to manage their finances effectively, they are less likely to experience mental health issues related to financial instability.

Benefits of Financial Literacy for Mental Well-being

- Empowerment: Financial education empowers individuals to make informed decisions about their money, leading to a sense of control and security.

- Reduced Stress: Increased financial knowledge can help alleviate stress and anxiety associated with money management, debt, and financial uncertainty.

- Improved Relationships: Better financial literacy can enhance communication and collaboration within relationships, reducing conflicts related to money matters.

Integrating Financial Education into Mental Health Programs

It is essential to incorporate financial education components into mental health programs to address the holistic well-being of individuals.

- Collaboration: Mental health professionals can partner with financial experts to provide comprehensive support for individuals struggling with both mental health and financial issues.

- Workshops and Seminars: Organize workshops and seminars that focus on financial literacy and its impact on mental health to raise awareness and provide practical tools for managing finances.

- Online Resources: Create online resources and modules that cover topics such as budgeting, saving, investing, and debt management to reach a wider audience.

Correlation between Financial Knowledge and Stress Levels

- Studies have shown that individuals with higher levels of financial literacy tend to experience lower levels of stress related to money management.

- Financial Confidence: Increased financial knowledge leads to greater confidence in making financial decisions, reducing the fear and uncertainty that often contribute to stress.

- Long-Term Planning: Understanding financial concepts like retirement planning and investment strategies can help individuals feel more secure about their future, minimizing anxiety.

Stigma Surrounding Financial and Mental Health Issues

In society, seeking help for financial or mental health problems can often be met with stigmas that discourage individuals from reaching out for support. These stigmas can result in negative consequences for those experiencing these challenges, preventing them from getting the help they need to improve their well-being.

Common Stigmas Associated with Seeking Help

- Financial Stigma: There is a misconception that financial problems are solely the result of poor money management or laziness, leading to feelings of shame and embarrassment when seeking assistance.

- Mental Health Stigma: Mental health issues are often misunderstood or stigmatized, with individuals facing judgment, discrimination, or fear of being labeled as weak or unstable.

Impact of Societal Perceptions

Societal perceptions can create barriers for individuals seeking help, causing them to suffer in silence and avoid addressing their financial and mental health concerns.

Breaking the Stigma

- Encouraging Open Conversations: By promoting open discussions about finance and mental health, we can create a supportive environment where individuals feel comfortable seeking help without fear of judgment.

- Educating and Raising Awareness: Providing education on the importance of mental health and financial well-being can help debunk myths and misinformation that contribute to stigma.

- Supporting Access to Resources: Increasing access to resources such as therapy, financial counseling, and support groups can empower individuals to seek help and improve their overall well-being.