Get ready to dive into the world of credit scores with these killer tips that will help you boost your financial game. Whether you’re a newbie or a pro, these strategies will get you on the right track to improving that all-important number.

In this guide, we’ll break down everything from understanding credit scores to monitoring your credit report and building a positive credit history. So, buckle up and let’s ride this wave of financial wisdom together.

Understanding Credit Score

Having a good credit score is crucial for many aspects of your financial life. Let’s dive into what a credit score is, how it’s calculated, and why it’s so important.

What is a Credit Score and How is it Calculated?

A credit score is a three-digit number that represents your creditworthiness, indicating how likely you are to repay your debts. It is calculated based on several factors, including:

- Your payment history

- Amount of debt you owe

- Length of credit history

- Types of credit used

- New credit inquiries

Factors Influencing a Credit Score

Several factors influence your credit score, such as:

- Payment History: Making on-time payments is crucial for a good credit score.

- Amount of Debt: The amount of debt you owe compared to your credit limits impacts your score.

- Length of Credit History: A longer credit history can positively affect your score.

- Types of Credit Used: Having a mix of credit types, such as credit cards and loans, can improve your score.

- New Credit Inquiries: Applying for new credit frequently can lower your score.

Importance of a Good Credit Score

Havig a good credit score is important because it can:

- Impact your ability to get approved for loans or credit cards

- Determine the interest rates you receive

- Affect your ability to rent an apartment or get a job

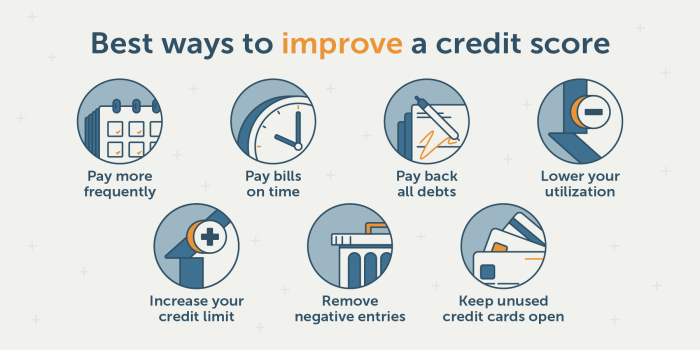

Tips to Improve Credit Score

Improving your credit score is essential for your financial well-being. By following these strategies, you can work towards a better credit standing.

Pay Bills on Time

One of the most crucial factors in determining your credit score is your payment history. Make sure to pay all your bills on time to avoid negative marks on your credit report.

Keep Credit Card Balances Low

High credit card balances can negatively impact your credit score. Aim to keep your credit card balances low to show that you can manage your credit responsibly.

Consolidate Debt

Consolidating your debt can help simplify your payments and lower your overall interest rates. By reducing the amount of debt you have, you can improve your credit score over time.

Monitoring Credit Report

Regularly checking your credit report is crucial in maintaining a healthy financial profile. Your credit report reflects your credit history and influences your credit score, which in turn affects your ability to secure loans, credit cards, or even rent an apartment.

Common Errors in Credit Reports and How to Dispute Them

- Incorrect personal information: Ensure your name, address, and other personal details are accurate.

- Accounts not belonging to you: Look out for any unfamiliar accounts listed on your report.

- Incorrect payment status: Check if any late payments or defaults are inaccurately reported.

Disputing errors on your credit report involves contacting the credit bureau and providing evidence to support your claim.

Ways to Protect Your Credit Information from Fraud or Identity Theft

- Monitor your accounts regularly for any suspicious activity.

- Use strong, unique passwords for your financial accounts.

- Avoid sharing personal information over unsecured networks or websites.

Building a Positive Credit History

Building a positive credit history is crucial for maintaining a good credit score. Establishing a solid credit history shows lenders that you are a responsible borrower, which can lead to better interest rates and more favorable loan terms. Let’s delve into some key aspects of building a positive credit history.

Importance of a Diverse Credit Mix

Having a diverse credit mix is important for demonstrating your ability to manage different types of credit responsibly. Lenders like to see a mix of credit accounts, such as credit cards, installment loans, and mortgages, as it shows that you can handle various financial obligations effectively.

- Consider diversifying your credit mix by opening different types of credit accounts.

- Make sure to make timely payments on all of your credit accounts to show responsible credit management.

- Monitor your credit utilization ratio to ensure you are not using too much of your available credit.

Establishing Credit with No Credit History

If you have no credit history, it can be challenging to get approved for credit. However, there are steps you can take to establish credit and start building a positive credit history:

- Apply for a secured credit card, where you provide a security deposit that serves as your credit limit.

- Become an authorized user on someone else’s credit card to piggyback off their positive credit history.

- Consider getting a credit builder loan, which is designed to help individuals establish credit.

Impact of Credit History Length on Credit Score

The length of your credit history plays a significant role in determining your credit score. A longer credit history demonstrates to lenders how well you have managed credit over time. Here are some tips on how the length of credit history can impact your credit score:

- Keep your oldest credit accounts open to maintain a longer credit history.

- Avoid closing old accounts, as this can shorten your average credit age and potentially lower your credit score.

- Consistently make on-time payments to build a positive credit history over time.