Diving into the world of Roth IRAs, this intro sets the stage with a sneak peek into the perks and advantages that come with this unique investment tool. Brace yourself for a journey filled with financial wisdom and savvy tips that will make you rethink your saving strategies.

In the world of finance, few tools offer the flexibility and growth potential of a Roth IRA. Let’s explore why this investment option is a game-changer for anyone looking to secure their financial future.

Introduction to Roth IRA

A Roth IRA is a type of individual retirement account that offers tax-free growth and tax-free withdrawals in retirement. Unlike traditional IRAs, contributions to a Roth IRA are made with after-tax dollars.

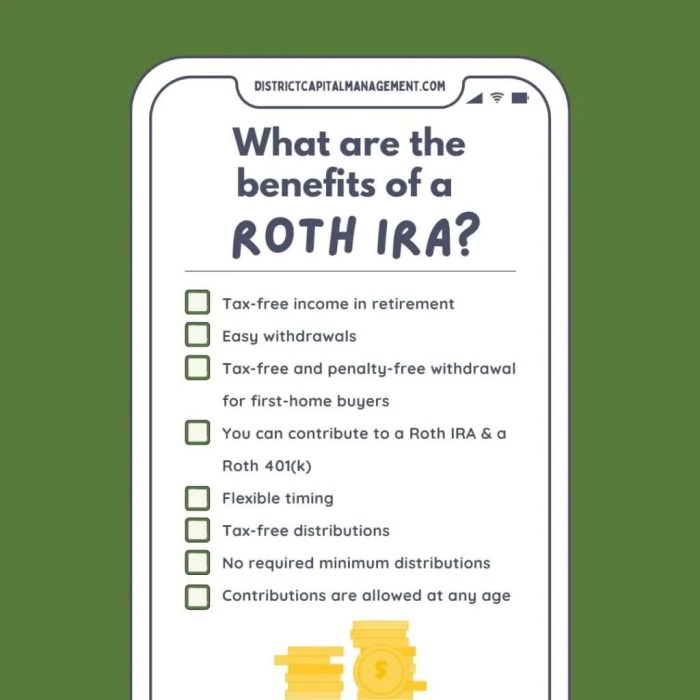

Key Features of a Roth IRA

- Contributions are made with after-tax dollars

- Earnings grow tax-free

- Qualified withdrawals in retirement are tax-free

- No required minimum distributions during the account holder’s lifetime

Eligibility Criteria for Opening a Roth IRA

To open a Roth IRA, individuals must meet certain criteria:

- Have earned income

- Meet specific income limits set by the IRS

- File taxes as single, head of household, or married filing jointly

Tax Advantages

Roth IRAs offer several tax benefits that make them an attractive retirement savings option. Unlike traditional IRAs, contributions to a Roth IRA are made with after-tax dollars, meaning you won’t get a tax deduction when you contribute. However, the real benefit comes later when you start making withdrawals.

Tax-Free Growth

One of the key advantages of a Roth IRA is that your investments can grow tax-free. This means you won’t have to pay taxes on any capital gains, dividends, or interest earned within the account. Over time, this tax-free growth can significantly increase the value of your retirement savings.

Tax-Free Withdrawals

Another major advantage of a Roth IRA is that qualified withdrawals are tax-free. This means that when you start taking money out of your Roth IRA in retirement, you won’t owe any taxes on the withdrawals. This can be a huge benefit, especially if you expect to be in a higher tax bracket in retirement.

Comparison to Traditional IRAs

In contrast, traditional IRAs offer a tax deduction on contributions, meaning you can lower your taxable income in the year you make the contribution. However, you’ll have to pay taxes on both your contributions and investment gains when you withdraw the money in retirement. This can result in a significant tax bill, depending on your tax bracket at that time.

Contribution Limits and Rules

When it comes to contributing to a Roth IRA, there are specific limits and rules that you need to be aware of to make the most of this retirement savings account.

Contribution Limits

- For 2021, the maximum contribution limit for a Roth IRA is $6,000 for individuals under 50 years old.

- If you are 50 or older, you can make an additional catch-up contribution of $1,000, bringing your total contribution limit to $7,000.

- These limits are based on your modified adjusted gross income (MAGI) and can change annually, so it’s important to stay updated on any adjustments.

Income Limits

- There are income limits for contributing to a Roth IRA. For 2021, single filers must have a MAGI below $140,000 to make a full contribution, with a phase-out range up to $125,000.

- Married couples filing jointly must have a MAGI below $208,000 for full contributions, with a phase-out range up to $198,000.

- If your income exceeds these limits, you may not be eligible to contribute directly to a Roth IRA, but there are alternative strategies like a backdoor Roth IRA conversion.

Withdrawal Rules

- When it comes to withdrawing funds from a Roth IRA, you can typically withdraw your contributions at any time without taxes or penalties, as they have already been taxed.

- However, if you withdraw earnings before age 59 ½ and before the account has been open for at least five years, you may face taxes and penalties.

- It’s essential to understand the rules around withdrawals to avoid any unnecessary taxes or penalties and make informed decisions about your retirement savings.

Investment Options

When it comes to investing in a Roth IRA, there are various options available that can help you grow your savings over time. Diversification is key to managing risk and maximizing returns within a Roth IRA. By spreading your investments across different asset classes, you can reduce the impact of market volatility on your overall portfolio.

Types of Investment Options

- Stocks: Investing in individual stocks allows you to own a piece of a company and potentially benefit from its growth.

- Bonds: Bonds are debt securities issued by governments or corporations, providing a fixed income stream.

- Mutual Funds: Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities.

- Exchange-Traded Funds (ETFs): ETFs are similar to mutual funds but trade on stock exchanges like individual stocks.

- Real Estate Investment Trusts (REITs): REITs allow you to invest in real estate properties without directly owning them.

Diversifying your investments across these different asset classes can help reduce risk and potentially increase returns over the long term.

Impact of Investment Choices

- Long-Term Growth: The investment choices you make within your Roth IRA can have a significant impact on your long-term growth potential. By selecting a mix of investments that align with your risk tolerance and financial goals, you can position yourself for steady growth over time.

- Risk Management: Diversifying your investments can help mitigate the impact of market fluctuations on your portfolio. By spreading your assets across different types of investments, you can reduce the overall risk of your portfolio.

- Tax Efficiency: Certain investments within a Roth IRA can offer tax advantages, such as tax-free growth and withdrawals. By strategically choosing tax-efficient investments, you can maximize the benefits of investing in a Roth IRA.

Flexibility and Accessibility

Roth IRAs offer a unique level of flexibility and accessibility that make them a valuable tool for financial planning.

Flexibility of Roth IRA Contributions

Unlike traditional IRAs, Roth IRAs allow you to withdraw your contributions penalty-free at any time. This means you can access the money you’ve put into your Roth IRA without worrying about taxes or penalties. Additionally, there are no required minimum distributions (RMDs) for Roth IRAs during your lifetime, giving you the flexibility to leave your money invested for as long as you like.

Accessibility of Funds in a Roth IRA

While it’s generally recommended to leave your Roth IRA untouched for as long as possible to maximize tax-free growth, you can access your earnings under certain conditions. For example, you can withdraw up to $10,000 of earnings penalty-free for a first-time home purchase, or use the funds for qualified higher education expenses. This accessibility can make a Roth IRA a versatile savings vehicle for various financial goals.

Using Roth IRAs for Various Financial Goals

Roth IRAs can be used for a wide range of financial goals, from retirement savings to buying a home or funding education expenses. Their flexibility and accessibility make them a powerful tool for building wealth and achieving your financial objectives. By taking advantage of the tax-free growth and withdrawal benefits of a Roth IRA, you can secure your financial future while still having the option to access your funds when needed.

Estate Planning Benefits

Roth IRAs offer unique advantages when it comes to estate planning. Not only can they benefit the original account holder during retirement, but they can also be a valuable tool for passing on wealth to beneficiaries.

Passing on a Roth IRA

When a Roth IRA is passed on to beneficiaries, they have the option to continue the tax-free growth of the account. This means that beneficiaries can inherit the Roth IRA without having to pay taxes on the distributions, making it a valuable asset for passing on wealth efficiently.

- Roth IRAs do not have required minimum distributions (RMDs) during the original account holder’s lifetime, allowing the account to continue growing tax-free for as long as possible.

- Beneficiaries who inherit a Roth IRA can choose to take distributions over their lifetime, spreading out the tax benefits and potentially minimizing their tax liability.

- By designating beneficiaries on a Roth IRA account, the assets can bypass the probate process, allowing for a smoother transfer of wealth.

Comparing Estate Planning Advantages

When compared to traditional IRAs or other retirement accounts, Roth IRAs offer distinct advantages in estate planning.

Roth IRAs provide tax-free distributions to beneficiaries, unlike traditional IRAs which may be subject to income tax.

- Traditional IRAs are subject to RMDs, which can limit the tax-deferred growth of the account and potentially result in higher tax liabilities for beneficiaries.

- Roth IRAs allow for greater flexibility in passing on wealth, as beneficiaries can continue to benefit from tax-free growth even after the original account holder’s passing.