Yo, let’s break it down for you – Understanding inflation rates is crucial in navigating the economic landscape. From impacting your cash flow to everyday expenses, this topic is more than just numbers on a screen. Get ready to dive into the world of inflation like never before.

What is Inflation?

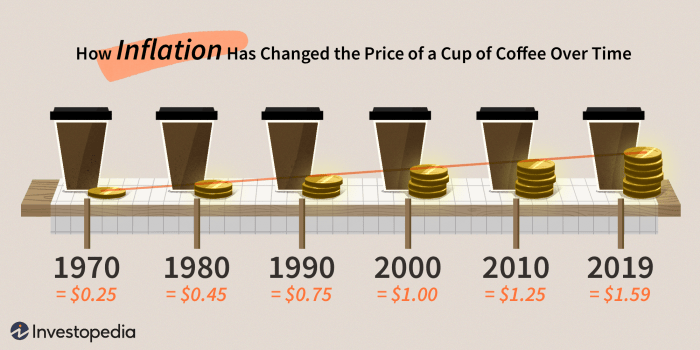

Inflation is the rate at which the general level of prices for goods and services rises, leading to a decrease in the purchasing power of a currency. It is typically measured as an annual percentage increase in prices.

Impact on Purchasing Power

Inflation reduces the purchasing power of a currency, meaning that each unit of currency buys fewer goods and services. For example, if inflation is 3% annually, a $1 item will cost $1.03 in a year.

Examples of Inflation’s Impact

- Increased Cost of Living: Inflation can lead to higher prices for everyday items like groceries, gas, and rent, making it more expensive for consumers to maintain their standard of living.

- Effect on Savings: Inflation erodes the value of savings over time, as the money saved today will buy fewer goods in the future due to rising prices.

- Wage Adjustments: In response to inflation, employers may increase wages to help employees maintain their purchasing power, but this can also lead to higher costs for businesses.

Types of Inflation

Inflation can be categorized into different types based on the factors that contribute to its rise. Two common types of inflation are demand-pull inflation and cost-push inflation.

Demand-Pull Inflation

Demand-pull inflation occurs when the demand for goods and services exceeds the available supply. This leads to an increase in prices as businesses raise prices to meet the high demand. For example, if there is a sudden increase in consumer spending due to a booming economy, demand-pull inflation can occur. This type of inflation is often associated with economic growth and can lead to an increase in wages as well.

Cost-Push Inflation

Cost-push inflation happens when the cost of production increases, leading to higher prices for consumers. This can be caused by factors such as rising wages, increased raw material costs, or higher taxes. For instance, if there is a spike in oil prices, businesses may need to raise prices to cover the increased cost of production. Cost-push inflation can be detrimental to consumers as it reduces their purchasing power.

Comparing the effects of demand-pull and cost-push inflation on the economy, demand-pull inflation is often seen as a sign of a healthy economy with strong consumer demand and economic growth. On the other hand, cost-push inflation can be more challenging as it can lead to reduced purchasing power for consumers and lower overall economic activity. Both types of inflation can have varying impacts on different sectors of the economy, highlighting the importance of understanding the causes and effects of inflation.

Factors Influencing Inflation Rates

Inflation rates are influenced by various factors that impact the overall economy. Understanding these key factors is crucial in analyzing the changes in inflation rates.

Government Policies

Government policies play a significant role in influencing inflation rates. For example, expansionary fiscal policies, such as increased government spending or tax cuts, can lead to higher inflation rates by boosting demand in the economy.

Supply and Demand Dynamics

The relationship between supply and demand in the market also affects inflation rates. When demand exceeds supply, prices tend to rise, leading to inflation. Conversely, when supply exceeds demand, prices may fall, resulting in deflation.

External Factors

External factors, such as global economic conditions, geopolitical events, and natural disasters, can also influence inflation rates. For instance, disruptions in the supply chain due to a natural disaster can lead to supply shortages and higher prices, contributing to inflation.

Interest Rates and Exchange Rates

Changes in interest rates and exchange rates can have a direct impact on inflation rates. Central banks often use interest rate adjustments to control inflation. Higher interest rates can help curb inflation by reducing spending, while lower interest rates can stimulate economic growth but may also lead to higher inflation. Exchange rate fluctuations can affect the prices of imported goods, thereby influencing inflation rates.

Measuring Inflation

Inflation is a crucial economic indicator that impacts various aspects of our daily lives. To accurately measure inflation rates, economists and policymakers rely on specific methods and tools to track changes in prices over time.

Consumer Price Index (CPI)

The Consumer Price Index (CPI) is one of the most commonly used metrics to measure inflation. It calculates the average change in prices paid by consumers for a basket of goods and services over a specific period. By tracking the CPI, analysts can assess the impact of price fluctuations on the cost of living for the average consumer.

- The CPI is calculated by collecting price data for a predetermined basket of goods and services, which represent the typical spending patterns of households.

- Weights are assigned to each item in the basket based on its relative importance in the average consumer’s budget.

- By comparing the current CPI to a base year, analysts can determine the percentage change in prices and the corresponding inflation rate.

For example, if the CPI in the current year is 110 and the base year CPI was 100, the inflation rate would be calculated as (110-100)/100 = 10%.

Collection and Analysis of Inflation Data

Governments and organizations employ various methods to collect and analyze inflation data to make informed decisions and formulate economic policies.

- Government agencies gather price information from thousands of retail outlets, service providers, and online sources to compile the CPI data.

- Statisticians use sophisticated statistical techniques to adjust for quality changes, substitutions, and other factors that may affect price movements.

- Economists analyze inflation data to identify trends, assess the impact of monetary policies, and make projections about future economic conditions.