Get ready to dive into the world of credit limit increase tips with a fresh perspective that resonates with American high school hip style. From understanding the factors that impact credit limit adjustments to exploring strategies for requesting an increase, this guide is your ticket to maximizing your financial potential.

Let’s explore the key elements that can help you navigate the world of credit limits and empower you to make informed decisions about your financial future.

Factors impacting credit limit increases

When it comes to getting a credit limit increase, there are several factors that come into play. Let’s break down how credit card issuers determine these increases and what role your credit score plays in the process.

Credit Limit Determination

The credit card issuer will typically review your payment history, income, and credit score to assess whether you are eligible for a credit limit increase. They want to see a track record of responsible credit usage before granting you more credit.

Credit Score Influence

Your credit score is a key factor in determining whether you qualify for a credit limit increase. A higher credit score usually indicates that you are a responsible borrower, making you more likely to receive a higher credit limit.

Responsible Credit Usage Examples

Making on-time payments, keeping your credit utilization low, and avoiding maxing out your credit cards are all examples of responsible credit usage that can increase your chances of getting a credit limit boost.

Other Factors Impacting Credit Limit Adjustments

In addition to your credit score, factors such as your income, overall credit history, and the issuer’s policies can also influence credit limit adjustments. Demonstrating financial stability and responsible credit management can go a long way in convincing the issuer to increase your credit limit.

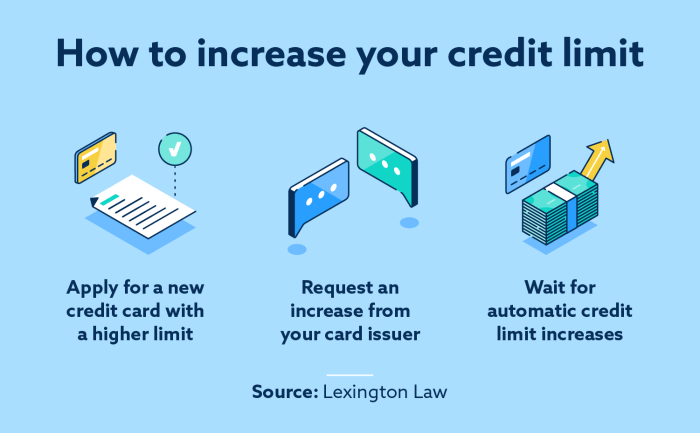

Strategies for requesting a credit limit increase

When it comes to requesting a credit limit increase from your credit card issuer, there are several key strategies to keep in mind to increase your chances of success. By following these steps and showcasing responsible credit card usage, you can improve your chances of securing a credit limit increase.

Steps for Requesting a Credit Limit Increase

- Check Your Credit Score: Before requesting a credit limit increase, make sure to check your credit score. A higher credit score can increase your chances of approval.

- Call Your Credit Card Issuer: Reach out to your credit card issuer via phone to request a credit limit increase. Be prepared to provide information about your income and reasons for the increase.

- Choose the Right Timing: The best time to request a credit limit increase is after you have made on-time payments for several months and have demonstrated responsible credit card usage.

- Follow Up with a Written Request: After your initial phone call, consider sending a written request for a credit limit increase to your credit card issuer for documentation purposes.

Showcasing Responsible Credit Card Usage

- Make On-Time Payments: Demonstrating a history of on-time payments can show your credit card issuer that you are a responsible borrower.

- Keep Credit Utilization Low: Aim to keep your credit card utilization below 30% to show that you are not overly reliant on credit.

- Avoid Opening New Accounts: Opening new credit accounts can signal to your credit card issuer that you may be taking on too much debt.

Successful Negotiation Techniques

- Highlight Your Payment History: Emphasize your on-time payment history and responsible credit card usage when speaking with your credit card issuer.

- Be Courteous and Professional: Approach the request for a credit limit increase with a positive attitude and professionalism to increase your chances of success.

- Be Flexible: If your credit card issuer offers a lower increase than you requested, consider accepting it and continuing to demonstrate responsible credit card usage for future increases.

Impact of credit limit increases on credit score

When it comes to credit limit increases, understanding how they can affect your credit score is crucial. Let’s dive into the details.

Credit Utilization Ratio

A credit limit increase can have a significant impact on an individual’s credit utilization ratio. This ratio is the amount of credit you are currently using compared to the total credit available to you. When your credit limit increases, but your spending remains the same, your credit utilization ratio decreases. A lower credit utilization ratio is generally seen as a positive factor for your credit score.

Positive Effects on Credit Score

One of the potential positive effects of a credit limit increase is the improvement of your credit score. As mentioned earlier, a lower credit utilization ratio can positively impact your credit score. Additionally, having a higher credit limit can also demonstrate to lenders that you are a responsible borrower who can handle larger amounts of credit.

Negative Consequences of Requesting a Credit Limit Increase

While there are many benefits to a credit limit increase, there are also potential negative consequences. When you request a credit limit increase, the creditor may perform a hard inquiry on your credit report, which can temporarily lower your credit score. Additionally, if you are not able to manage the increased credit responsibly, it could lead to overspending and a higher credit utilization ratio.

Tips to Mitigate Negative Impacts

To mitigate any negative impacts on your credit score when requesting a credit limit increase, consider spacing out your credit limit increase requests to minimize the number of hard inquiries on your credit report. It’s also essential to continue monitoring your credit utilization ratio and keep your spending in check to ensure that you are not accumulating more debt than you can handle.

Alternatives to a credit limit increase

Credit limit increases are not the only solution to managing credit card balances. There are alternative strategies that individuals can explore to handle their finances effectively without relying solely on increasing their credit limit.

1. Budgeting and Tracking Expenses

Creating a budget and tracking expenses can help individuals understand their spending habits better. By setting limits on different categories of expenses, such as groceries, entertainment, or dining out, individuals can prioritize their spending and avoid exceeding their credit card limits.

2. Debt Repayment Strategies

Implementing debt repayment strategies, such as the snowball or avalanche method, can help individuals pay off their outstanding balances faster. By focusing on high-interest debts first or starting with the smallest balances, individuals can make progress towards reducing their overall debt and improve their credit score.

3. Utilizing Credit Card Rewards

Instead of relying on a credit limit increase, individuals can take advantage of credit card rewards to offset their expenses. Cashback rewards, travel points, or discounts on purchases can help individuals save money and reduce the need to increase their credit limit.

4. Seeking Financial Counseling or Education

For individuals struggling to manage their credit card balances, seeking financial counseling or education can provide valuable insights and strategies. Financial advisors can offer personalized guidance on budgeting, debt management, and improving financial habits to avoid the need for a credit limit increase.

5. Exploring Balance Transfer Options

Transferring high-interest credit card balances to a card with a lower interest rate can help individuals save money on interest and pay off their debts faster. Balance transfer offers often come with promotional rates, allowing individuals to consolidate their debts and make payments more manageable.