Get ready to dive into the world of investing with a cool twist as we explore How to invest in commodities. This guide is your ticket to understanding the ins and outs of adding commodities to your investment mix, so buckle up and let’s roll!

In the following sections, we’ll break down the different ways to invest in commodities, factors influencing their prices, and the risks and challenges you might encounter along the way. So, grab your shades and let’s get started!

Introduction to Commodities Investing

Commodities are raw materials or primary agricultural products that can be bought and sold. In the context of investing, commodities refer to goods or products that are traded on exchanges to generate profits.

Types of Commodities

- Precious Metals: Gold, silver, platinum

- Energy: Crude oil, natural gas

- Agricultural: Wheat, corn, soybeans

Benefits of Including Commodities in an Investment Portfolio

- Diversification: Commodities can provide a hedge against inflation and economic downturns.

- Profit Potential: Commodities can offer high returns, especially during times of market volatility.

- Global Demand: Commodities are essential for various industries, ensuring consistent demand.

Popular Commodities in the Market

- Gold: Known as a safe-haven asset, gold is often used as a store of value in times of uncertainty.

- Crude Oil: One of the most traded commodities, crude oil plays a crucial role in the global economy.

- Corn: A staple crop with diverse uses, corn is a popular agricultural commodity among investors.

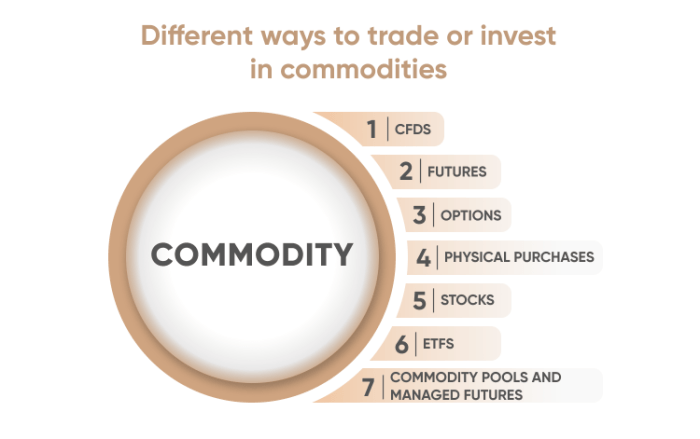

Ways to Invest in Commodities

Investing in commodities can be done through various methods, each with its own set of risks and benefits. It’s important to understand the different options available before diving in.

1. Futures

Futures contracts are agreements to buy or sell a commodity at a predetermined price on a specific date in the future. This method allows investors to speculate on the price movements of commodities without actually owning them. However, futures trading can be highly leveraged, making it risky for beginners.

2. Options

Options give investors the right, but not the obligation, to buy or sell a commodity at a specific price within a set time frame. This method provides flexibility and limited risk, as investors can choose whether or not to exercise their options. However, options trading requires a good understanding of market conditions and can be complex for beginners.

3. Stocks

Investing in commodity-related stocks allows investors to indirectly participate in the commodity market. This method provides diversification and the opportunity to benefit from the growth of companies involved in commodity production or distribution. However, stock prices can be influenced by factors other than commodity prices, adding an additional layer of risk.

4. ETFs

Exchange-traded funds (ETFs) are investment funds that trade on stock exchanges and track the performance of a specific commodity or a basket of commodities. ETFs provide easy access to commodity markets and offer diversification within a single investment. However, like stocks, ETF prices can be influenced by various market factors.

Risks and Liquidity

Each investment method comes with its own set of risks, such as price volatility, leverage, and market factors. Futures and options trading can be particularly risky due to leverage, while stocks and ETFs are subject to broader market conditions. In terms of liquidity, futures and ETFs tend to be more liquid than options and physical assets, making them easier to buy and sell.

Tips for Beginners

For beginners looking to start investing in commodities, it’s important to start small and do thorough research. Consider paper trading or using a demo account to practice trading without risking real money. Develop a solid trading plan and stick to it, while also staying informed about market trends and news that may impact commodity prices. Seek guidance from experienced investors or financial advisors to navigate the complexities of commodity investing effectively.

Factors Influencing Commodities Prices

Commodity prices are influenced by a variety of factors that can impact supply and demand, geopolitical events, economic indicators, and speculative activities in the market.

Supply and Demand

Supply and demand dynamics play a crucial role in determining commodity prices. When demand exceeds supply, prices tend to rise, and vice versa.

- Factors affecting supply: weather conditions, geopolitical instability, production disruptions.

- Factors affecting demand: economic growth, population growth, changes in consumer preferences.

Macroeconomic Trends

Macroeconomic trends such as inflation, interest rates, and currency fluctuations can have a significant impact on commodity prices.

- Inflation: High inflation erodes purchasing power, leading investors to seek commodities as a hedge against inflation.

- Interest rates: Changes in interest rates can affect borrowing costs for producers, influencing supply and demand for commodities.

Role of Speculation

Speculation in the commodity market can lead to price fluctuations that are not necessarily driven by supply and demand fundamentals.

- Speculative activities: Futures trading, hedge fund investments, and market sentiment can influence commodity prices.

- Speculative bubbles: Excessive speculation can create bubbles, causing prices to deviate from their intrinsic value.

Historical Events

Historical events have had a significant impact on commodity prices, shaping market trends and investor sentiment.

- Oil crisis in the 1970s: Middle East oil embargo led to a spike in oil prices, affecting global economies.

- Global financial crisis in 2008: Commodity prices plummeted due to reduced demand amid economic slowdown.

Risks and Challenges in Commodities Investing

Investing in commodities can offer lucrative opportunities, but it also comes with its fair share of risks and challenges. Understanding these risks is crucial for successful investing in this asset class.

Volatility in Commodity Prices

Commodity prices are inherently volatile due to various factors such as supply and demand dynamics, geopolitical events, and economic conditions. This volatility can lead to significant price fluctuations, making it challenging to predict future price movements.

- Geopolitical Risks: Political instability in key commodity-producing regions can disrupt the supply chain, leading to sudden price spikes or drops.

- Weather-Related Risks: Natural disasters like hurricanes, droughts, or floods can impact crop yields or disrupt mining operations, affecting commodity prices.

- Market Speculation: Speculative trading in commodity futures can exacerbate price volatility, making it difficult for investors to navigate the market.

Strategies for Managing Risks

To mitigate risks in commodities investing, investors can employ various strategies:

- Diversification: Spreading investments across different commodities can help reduce exposure to price fluctuations in any single market.

- Use of Derivatives: Hedging with futures contracts or options can protect against adverse price movements in the underlying commodity.

- Research and Analysis: Conducting thorough research and staying informed about market trends can help investors make better-informed decisions.

Common Challenges in Commodities Investing

Investors may face several challenges when dealing with commodities:

- Lack of Market Transparency: Commodities markets can be opaque, making it difficult to obtain accurate and timely information.

- Regulatory Risks: Changes in regulations or government policies can impact commodity prices and investment strategies.

- Storage and Transportation Costs: Physical commodities require storage and transportation, which can add to the overall cost of investing.

Insights on Mitigating Risks

To mitigate risks while investing in commodities, investors should:

- Stay Informed: Keep up to date with market developments, news, and global events that can affect commodity prices.

- Set Clear Investment Goals: Define your investment objectives and risk tolerance to align your portfolio with your financial goals.

- Seek Professional Advice: Consult with financial advisors or experts in commodities investing to get personalized guidance and recommendations.