Get ready to dive into the world of Budgeting techniques, where we break down everything you need to know about managing your finances like a pro. From basic strategies to advanced tips, this guide has got you covered.

Types of Budgeting Techniques

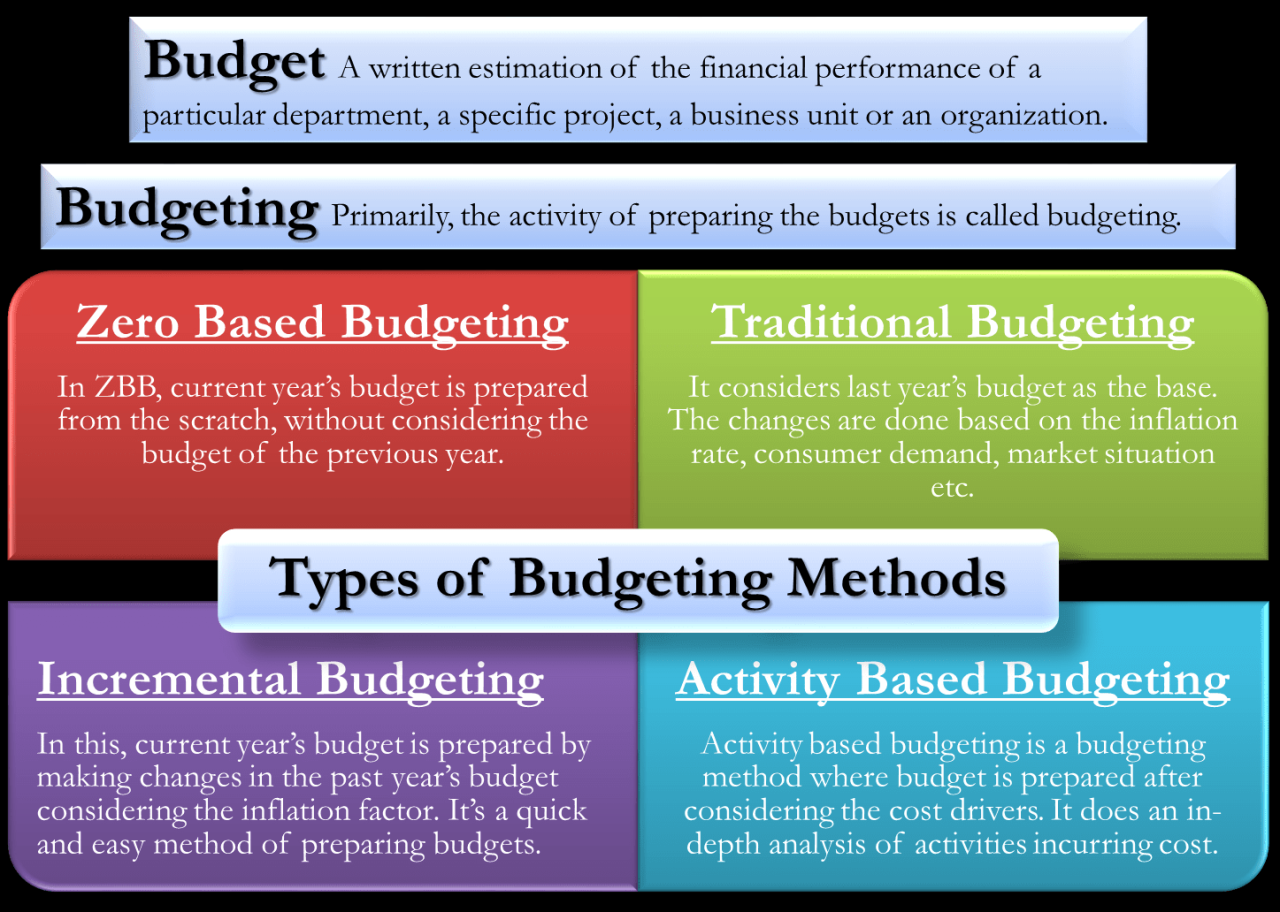

Budgeting techniques are essential in managing personal finances effectively. Different types of budgeting techniques are used to help individuals and companies allocate resources efficiently. Let’s explore some common budgeting techniques below.

Zero-Based Budgeting vs. Incremental Budgeting

Zero-based budgeting involves starting from scratch each budgeting period, where every expense must be justified regardless of the previous budget. On the other hand, incremental budgeting involves adjusting the previous budget by a certain percentage based on inflation, growth, or other factors.

- Zero-Based Budgeting: Requires detailed justification for all expenses, encourages cost-saving measures, and promotes efficient resource allocation.

- Incremental Budgeting: Easier to implement, provides stability in budgeting, but may lead to unnecessary expenses if not carefully monitored.

Advantages and Disadvantages of Activity-Based Budgeting

Activity-based budgeting focuses on the cost drivers of different activities within an organization to allocate resources more accurately.

- Advantages: Helps in identifying areas of inefficiencies, improves cost control, and enhances decision-making based on activity performance.

- Disadvantages: Requires detailed data collection, time-consuming to implement, and may not be suitable for all types of organizations.

Rolling Budgets in Financial Planning

Rolling budgets involve continuously updating the budget by adding a new budget period as the current period expires. This allows for more flexibility and adaptability in financial planning.

- Companies use rolling budgets to adjust their financial plans based on changing market conditions, performance trends, and other factors.

- It helps in forecasting more accurately, identifying variances, and making timely adjustments to achieve financial goals.

Implementing Budgeting Techniques

Budgeting is a crucial part of financial planning that helps individuals and businesses manage their money effectively. Implementing budgeting techniques involves several key steps to ensure success.

Creating a Successful Budget Plan

Before starting to budget, it’s essential to gather all financial information, including income, expenses, debts, and savings goals. The following steps can help create a successful budget plan:

- List all sources of income

- Track and categorize expenses

- Determine financial goals

- Create a budget that aligns with your goals

- Review and adjust the budget regularly

Tracking Expenses with Envelope Budgeting

Envelope budgeting is a method that involves allocating cash into separate envelopes for different spending categories. To track expenses effectively using this method, consider the following tips:

- Label each envelope with a specific spending category

- Only use cash from the designated envelope for that category

- Regularly review the amount left in each envelope

- Adjust allocations based on spending habits

Setting Financial Goals

Setting financial goals is crucial before implementing any budgeting technique. Without clear goals, it can be challenging to stay motivated and track progress. Examples of financial goals include:

- Building an emergency fund

- Paying off debt

- Saving for a major purchase

- Investing for retirement

Budgeting Software

Budgeting software can streamline the budgeting process by automating tasks and providing insights into spending habits. Some popular budgeting software options include:

- Mint

- You Need a Budget (YNAB)

- Personal Capital

- Quicken

Advanced Budgeting Strategies

When it comes to advanced budgeting strategies, there are several techniques that can help individuals manage their finances more effectively and make informed decisions. Let’s delve into some key strategies that can take your budgeting game to the next level.

Zero-Sum Budgeting

Zero-sum budgeting is a technique where every dollar of income is allocated to a specific category, whether it’s savings, expenses, or investments. The main idea is to give every dollar a job, leaving no money unaccounted for. By implementing zero-sum budgeting, individuals can better track their spending, prioritize financial goals, and ensure that they are living within their means.

Forecasting in Budgeting

Forecasting plays a crucial role in budgeting as it involves predicting future income and expenses based on past trends and current financial data. By forecasting, individuals can anticipate potential financial challenges, plan for large expenses, and make proactive decisions to improve their financial health. It helps in setting realistic financial goals and creating a roadmap for achieving them.

50/30/20 Rule

The 50/30/20 rule is a popular budgeting strategy that suggests allocating 50% of income to needs, 30% to wants, and 20% to savings or debt repayment. This rule provides a simple yet effective framework for individuals to prioritize their spending and savings goals. By following this rule, individuals can achieve a balance between meeting their essential needs, enjoying discretionary expenses, and building a financial safety net.

Adjusting Budget for Unexpected Expenses

When unexpected expenses arise, it’s important to adjust your budget accordingly to accommodate these additional costs. This may involve cutting back on certain discretionary expenses, tapping into emergency funds, or finding alternative sources of income. By being flexible and proactive in adjusting your budget, you can navigate through financial challenges and stay on track towards your long-term financial goals.

Tools and Resources for Budgeting

Budgeting is essential for managing personal finances effectively. Utilizing the right tools and resources can make the process easier and more efficient. Here, we will explore popular budgeting apps, software, spreadsheets, and automation tools that can assist in tracking expenses and sticking to a budget.

Popular Budgeting Apps and Software

- Mint: A free app that allows users to track expenses, create budgets, and receive alerts for upcoming bills.

- YNAB (You Need a Budget): Paid software focused on zero-based budgeting, helping users assign every dollar a job.

- EveryDollar: Dave Ramsey’s budgeting app that follows the principles of his financial teachings.

Comparison of Free vs Paid Budgeting Tools

- Free budgeting tools like Mint offer basic budgeting features, while paid tools like YNAB provide more in-depth budgeting strategies and personalized support.

- Paid tools often come with additional features such as investment tracking, debt payoff calculators, and financial goal setting.

- Users can decide based on their budgeting needs and preferences whether to opt for a free or paid tool.

Benefits of Using Spreadsheets for Budgeting

Spreadsheets are versatile tools that can be customized to suit individual budgeting needs. They allow users to input income, expenses, savings goals, and track progress over time. Here is a simple template for beginners to get started:

Monthly Budget Spreadsheet Template:

Category Budgeted Amount Actual Amount Difference Housing $1000 $950 $50 Transportation $200 $180 $20

Automation Tools for Expense Tracking

- Personal Capital: An automation tool that syncs with bank accounts to track expenses, investments, and net worth.

- Truebill: Helps users identify and cancel subscriptions, track spending, and optimize bills for savings.

- Trim: Automates bill negotiation, finds savings opportunities, and provides personalized financial insights.