Yo, diving into the world of Investment diversification, where we mix it up to maximize those gains. Get ready to level up your financial game with this breakdown of diversification that’s gonna blow your mind.

Let’s break down what it means, why it’s important, and how you can make it work for you.

Definition of Investment Diversification

Investment diversification in finance refers to the practice of spreading your investments across different asset classes to reduce risk. By diversifying, you aim to minimize the impact of a single investment’s performance on your overall portfolio.

Types of Assets for Diversification

- Stocks: Investing in shares of different companies across various industries.

- Bonds: Allocating funds to government or corporate bonds with different maturity dates and credit ratings.

- Real Estate: Including properties, REITs, or real estate crowdfunding platforms in your investment mix.

- Commodities: Investing in physical goods like gold, silver, oil, or agricultural products.

Benefits of Diversifying

- Reduced Risk: Spreading your investments can lower the impact of a single asset’s poor performance.

- Potential for Higher Returns: Diversification can lead to better overall returns by capturing gains from different sectors or asset classes.

- Stability: A diversified portfolio can provide more stability during market fluctuations or economic downturns.

Importance of Investment Diversification

Diversification is vital for managing investment risk as it involves spreading your investments across different asset classes, industries, and geographic regions. This strategy helps reduce the impact of market fluctuations on your overall portfolio.

Reducing Risk through Diversification

- Diversified portfolios are less susceptible to significant losses from a single investment or market sector downturn.

- By spreading your investments, you lower the overall risk of your portfolio, as losses in one area can be offset by gains in another.

- Reducing risk through diversification can lead to more stable returns over time, protecting your investment capital.

Comparing Diversified vs Non-Diversified Portfolios

- A non-diversified portfolio is more vulnerable to market volatility and economic downturns, as it relies heavily on the performance of a few investments.

- In contrast, diversified portfolios offer a more balanced risk exposure, helping to smooth out fluctuations and potentially increase returns.

- Investors with non-diversified portfolios may experience higher levels of stress and uncertainty during market turbulence compared to those with diversified holdings.

Achieving Long-Term Financial Goals with Diversification

- By diversifying your investments, you can align your portfolio with your long-term financial objectives, such as retirement planning or wealth accumulation.

- Diversification can help you stay invested through various market conditions, avoiding knee-jerk reactions to short-term fluctuations.

- Over time, a well-diversified portfolio can provide more consistent returns and help you reach your financial goals without taking on excessive risk.

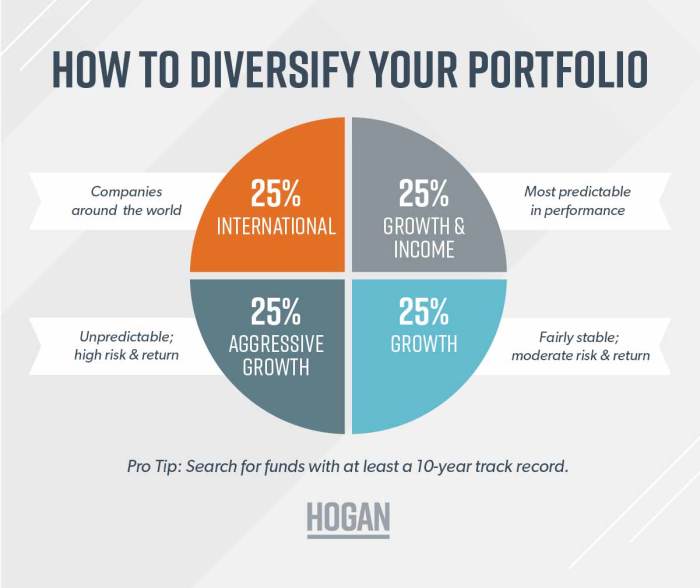

Strategies for Investment Diversification

Investment diversification is crucial in reducing risk and maximizing returns. One key strategy for achieving diversification is through asset allocation, which involves spreading investments across different asset classes to balance risk and reward.

Asset Allocation and Diversification

Asset allocation is the practice of dividing investments among different asset classes such as stocks, bonds, real estate, and commodities. By spreading investments across various assets, investors can reduce the impact of market volatility on their portfolio. For example, if one asset class performs poorly, the losses can be offset by gains in another asset class.

- Allocate investments based on risk tolerance and investment goals.

- Rebalance the portfolio periodically to maintain the desired asset allocation.

- Diversify within asset classes by investing in different industries or sectors.

Geographic Diversification

Geographic diversification involves investing in assets across different regions or countries to reduce the impact of economic and political events in a single location. This strategy can help mitigate risks associated with currency fluctuations, geopolitical instability, and regional economic downturns.

By spreading investments across various asset classes and geographic regions, investors can build a well-diversified portfolio that is better positioned to weather market fluctuations and achieve long-term financial goals.

Challenges and Risks of Investment Diversification

When it comes to diversifying your investment portfolio, there are several challenges and risks that investors need to be aware of in order to make informed decisions.

Common Challenges Investors Face

- Difficulty in choosing the right mix of assets to diversify into.

- Managing a large number of investments can become complex and time-consuming.

- Market volatility can make it hard to maintain a balanced diversification strategy.

Potential Risks of Over-Diversification

- Over-diversification can lead to diluted returns, as the impact of successful investments may be minimized.

- Increased transaction costs and fees can eat into overall returns.

- It may be challenging to stay informed about a large number of investments, leading to missed opportunities or poor decision-making.

Impact of Market Correlation

Market correlation refers to how different assets move in relation to each other. High market correlation can reduce the effectiveness of diversification as assets tend to move in the same direction during market fluctuations. It’s important for investors to consider the correlation between their investments to ensure proper diversification and risk management.