Secured vs. unsecured loans sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset.

When it comes to borrowing money, understanding the differences between secured and unsecured loans is crucial. This comparison will delve into the intricacies of each type of loan, shedding light on the nuances that can impact your financial decisions.

Secured vs. unsecured loans

When it comes to borrowing money, there are two main types of loans to consider: secured and unsecured loans. The key difference between the two lies in the presence of collateral. Secured loans require collateral, such as a house or a car, to secure the loan, while unsecured loans do not require any collateral.

Secured Loans

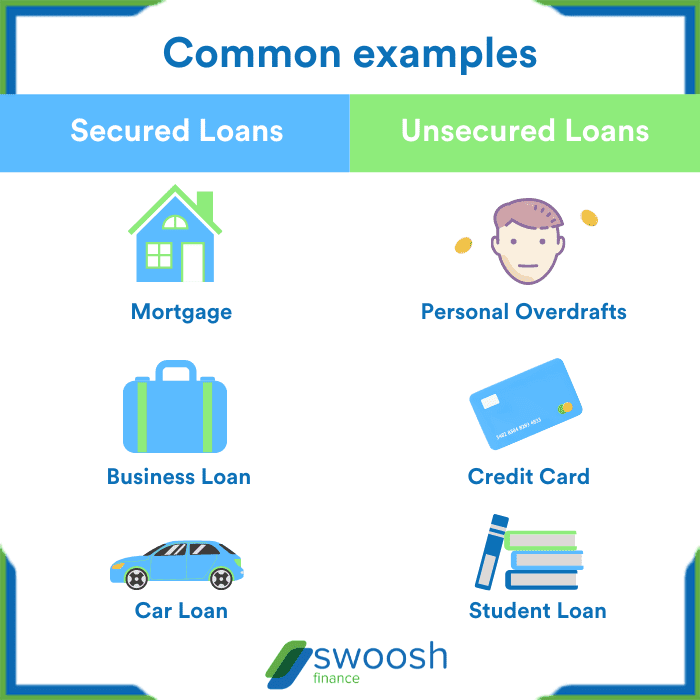

Secured loans are backed by collateral, which reduces the risk for the lender. Examples of secured loans include mortgage loans, auto loans, and home equity loans. In the event that the borrower defaults on the loan, the lender can seize the collateral to recoup their losses.

Unsecured Loans

Unsecured loans, on the other hand, do not require any collateral. Examples of unsecured loans include personal loans, student loans, and credit card loans. Since there is no collateral involved, unsecured loans are riskier for lenders, which is why they typically come with higher interest rates compared to secured loans.

Importance of Collateral in Secured Loans

Collateral plays a crucial role in secured loans as it provides security for the lender. By having collateral to back the loan, lenders are more willing to offer lower interest rates and larger loan amounts. This is because they have a way to recover their funds in case the borrower defaults on the loan.

Interest Rates in Secured vs. Unsecured Loans

Due to the reduced risk for lenders, secured loans generally come with lower interest rates compared to unsecured loans. Lenders are more confident in the repayment of secured loans due to the presence of collateral, allowing them to offer more favorable terms to borrowers. On the other hand, unsecured loans pose a higher risk for lenders, resulting in higher interest rates to compensate for the increased risk.

Secured loans

When it comes to secured loans, borrowers are required to provide collateral to secure the loan. This collateral serves as a form of protection for the lender in case the borrower defaults on the loan. Secured loans typically have lower interest rates compared to unsecured loans due to the decreased risk for the lender.

Obtaining a secured loan

To obtain a secured loan, borrowers must first identify the type of collateral they can offer. This collateral can include valuable assets such as real estate, vehicles, or savings accounts. Once the collateral is determined, borrowers can apply for a secured loan with a financial institution, providing necessary documentation to support their application.

Types of collateral accepted for secured loans

- Real estate (e.g., property, home)

- Vehicles (e.g., cars, motorcycles)

- Savings accounts or certificates of deposit

- Jewelry or valuable collectibles

Risks of defaulting on a secured loan

Defaulting on a secured loan can have serious consequences for borrowers. If a borrower fails to repay the loan, the lender has the right to seize the collateral used to secure the loan. This could result in the loss of valuable assets and damage to the borrower’s credit score.

Advantages of secured loans for lenders

- Lower risk of financial loss due to collateral

- Ability to offer lower interest rates to borrowers

- Increased likelihood of loan repayment

Unsecured loans

When it comes to unsecured loans, these are loans that are not backed by any collateral, meaning you don’t have to put up any assets such as your home or car to secure the loan. Let’s dive into the details of unsecured loans.

Application process for unsecured loans

When applying for an unsecured loan, the process typically involves filling out an application form with your personal and financial information. Lenders will then review your credit score and financial history to determine your eligibility for the loan.

Criteria lenders consider when approving unsecured loans

- Your credit score: Lenders will look at your credit score to assess your creditworthiness and determine the interest rate you qualify for.

- Income and employment history: Lenders will also consider your income and employment stability to ensure you have the means to repay the loan.

- Debt-to-income ratio: Lenders will analyze your debt-to-income ratio to gauge your ability to manage additional debt responsibly.

Consequences of defaulting on an unsecured loan

If you default on an unsecured loan, it can have serious consequences such as damaging your credit score, facing collection actions, and even being taken to court by the lender to recover the debt.

Risks and benefits associated with providing unsecured loans

- Risks: Lenders face a higher risk with unsecured loans as there is no collateral to recover in case of default. This often results in higher interest rates for borrowers to compensate for the risk.

- Benefits: Unsecured loans offer borrowers quick access to funds without risking their assets. They are also a good option for individuals who do not have valuable assets to use as collateral.