When it comes to securing financial assistance, understanding the difference between secured and unsecured loans is crucial. This guide will walk you through the key aspects of each type of loan, shedding light on their unique characteristics and implications.

From collateral requirements to interest rates, risk factors to application processes, this exploration will equip you with the knowledge needed to make informed decisions about your financial future.

Definition of Secured vs. Unsecured Loans

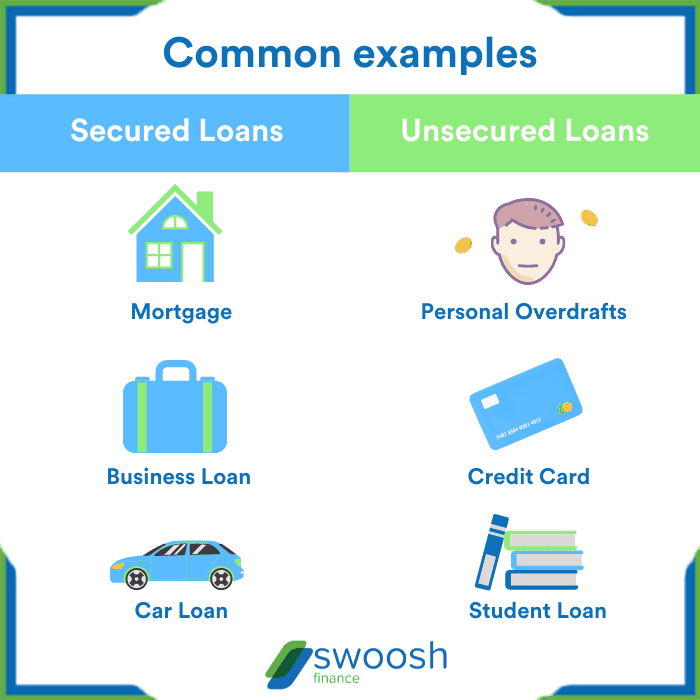

When it comes to loans, there are two main types to consider: secured and unsecured loans. Secured loans are backed by collateral, while unsecured loans are not.

Secured Loans

Secured loans require the borrower to provide collateral, which is an asset that the lender can take possession of if the borrower fails to repay the loan. Examples of secured loans include mortgage loans and auto loans. In the case of a mortgage loan, the house acts as collateral, while the car serves as collateral for an auto loan. The collateral reduces the risk for the lender, allowing them to offer lower interest rates compared to unsecured loans.

Unsecured Loans

Unsecured loans do not require any collateral and are based solely on the borrower’s creditworthiness. Examples of unsecured loans include personal loans and credit cards. Since there is no collateral involved, unsecured loans typically have higher interest rates to compensate for the increased risk taken on by the lender.

Significance of Collateral in Secured Loans

Collateral plays a crucial role in secured loans as it provides security for the lender in case the borrower defaults on the loan. This security allows lenders to offer larger loan amounts and better loan terms to borrowers. Additionally, the presence of collateral reduces the risk of the loan for the lender, resulting in lower interest rates for the borrower.

Interest Rates

When it comes to loans, one of the most crucial factors to consider is the interest rate. This is the amount charged by the lender for borrowing money, and it can significantly affect the total amount you repay over time. Let’s compare how interest rates work for secured and unsecured loans.

Secured Loans

Secured loans typically come with lower interest rates compared to unsecured loans. This is because secured loans are backed by collateral, such as a home or a car, which reduces the risk for the lender. In case the borrower defaults on the loan, the lender can seize the collateral to recover their funds.

Unsecured Loans

On the other hand, unsecured loans have higher interest rates since they do not require any collateral. Lenders consider unsecured loans riskier, as there is no asset to repossess if the borrower fails to repay. Therefore, to compensate for the increased risk, lenders charge higher interest rates on unsecured loans.

Credit Scores Impact

Credit scores play a significant role in determining the interest rates for both secured and unsecured loans. Borrowers with higher credit scores are considered less risky and are more likely to qualify for lower interest rates. On the contrary, borrowers with lower credit scores may face higher interest rates or struggle to get approved for a loan.

Risk Factors

When it comes to taking out loans, there are always risks involved. Whether you opt for a secured loan or an unsecured loan, it’s important to understand the potential consequences of defaulting. Let’s break down the risk factors associated with each type of loan.

Risk Factors of Secured Loans

Secured loans are backed by collateral, such as your home or car. While this can make them easier to qualify for and typically come with lower interest rates, there are significant risks involved. If you default on a secured loan, the lender has the right to seize your collateral to recoup their losses. This could result in losing your home or vehicle, making it crucial to make timely payments to avoid foreclosure or repossession.

Risk Factors of Unsecured Loans

On the other hand, unsecured loans do not require collateral, making them riskier for lenders. Due to the higher risk involved, unsecured loans often come with higher interest rates and stricter eligibility criteria. If you default on an unsecured loan, the lender may take legal action against you to recover the funds. This can result in wage garnishment, damage to your credit score, and potential lawsuits.

Consequences of Defaulting

The consequences of defaulting on a secured loan are more severe compared to unsecured loans. With a secured loan, you risk losing valuable assets that were used as collateral. On the other hand, defaulting on an unsecured loan can still have serious repercussions, such as a damaged credit score and legal action taken against you. It’s essential to carefully consider the risks involved with both types of loans before borrowing money.

Application Process

Secured loans typically require a more extensive application process compared to unsecured loans. Lenders will need to assess the value of the collateral you are offering to secure the loan.

Secured Loan Application Process

When applying for a secured loan, you will need to provide documentation related to the collateral you are using. This may include property documents, vehicle titles, or other assets that will serve as security for the loan.

- Proof of ownership of the collateral

- Appraisal documents for the collateral

- Personal identification documents

- Income verification documents

Unsecured Loan Documentation

For unsecured loans, the documentation required is generally less extensive since there is no collateral involved. Lenders will focus more on your creditworthiness and ability to repay the loan.

- Personal identification documents

- Income verification documents

- Credit history report

Approval Timeline

The approval timeline for secured loans is typically longer due to the need for collateral assessment and verification. This process can take several weeks to complete.

On the other hand, unsecured loans usually have a quicker approval timeline since the focus is more on the borrower’s creditworthiness. Approval for unsecured loans can be as quick as a few days, depending on the lender’s evaluation process.

Use of Funds

When it comes to the use of funds from secured and unsecured loans, there are some key differences to consider. Secured loans typically have restrictions on how the funds can be used, while unsecured loans offer more flexibility to borrowers.

Secured Loans

Secured loans are often tied to a specific asset, such as a home or a car. The funds from secured loans are typically used for large purchases like buying a new property, financing a vehicle, or making home improvements. Since the loan is secured by collateral, lenders have more control over how the funds are used to ensure the asset’s value is protected.

Unsecured Loans

On the other hand, unsecured loans do not require collateral, giving borrowers more freedom in using the funds. Common purposes for unsecured loans include debt consolidation, medical expenses, education costs, or even funding a vacation. The flexibility in using unsecured loan funds allows borrowers to address a variety of financial needs without risking their assets.