Get ready to dive deep into the world of growth stock strategies. From defining their importance to exploring key characteristics, this introduction sets the stage for an exciting journey through the realm of investing.

Gain valuable insights into fundamental and technical analysis, learn how to build a diversified growth stock portfolio, and discover the secrets to success in the dynamic world of investing.

Introduction to Growth Stock Strategies

Growth stock strategies refer to investment approaches focused on companies with high potential for future growth and expansion. These strategies are significant in investing as they offer the opportunity for investors to capitalize on the growth prospects of dynamic companies in various sectors.

Key Characteristics of Growth Stocks:

- Strong Revenue Growth: Growth stocks typically exhibit consistent and robust revenue growth over time, indicating their potential for expansion.

- High Valuation: These stocks often trade at higher valuation multiples compared to value stocks due to their growth potential.

- Innovative and Disruptive: Growth stocks are often associated with innovative products or services that have the potential to disrupt existing markets.

- Minimal Dividend Payments: Companies following growth stock strategies reinvest their profits back into the business rather than distributing them as dividends.

Examples of Successful Companies Employing Growth Stock Strategies:

- Amazon: Known for its continuous innovation and expansion into new markets, Amazon has been a prime example of a growth stock.

- Apple: With its focus on technological advancements and product diversification, Apple has demonstrated strong growth potential over the years.

- Tesla: Tesla’s disruptive approach to the automotive industry and its ambitions in renewable energy have positioned it as a prominent growth stock.

Fundamental Analysis for Growth Stocks

When it comes to evaluating growth stocks, fundamental analysis plays a crucial role in determining the future potential of a company. This type of analysis focuses on assessing the intrinsic value of a stock based on various financial and qualitative factors.

Components of Fundamental Analysis for Growth Stocks

- Earnings Growth: Analyzing the historical and projected earnings growth of a company to understand its potential for future growth.

- Revenue Growth: Examining the company’s revenue growth trends to determine its ability to increase sales over time.

- Profit Margins: Assessing the company’s profit margins to see how efficiently it is able to generate profits from its operations.

- Market Share: Evaluating the company’s market share and competitive positioning within its industry.

Assessing a Company’s Growth Potential Using Fundamental Analysis

By analyzing these components and other key financial metrics, investors can get a comprehensive view of a company’s growth potential. This helps in making informed decisions about investing in growth stocks.

Comparing Fundamental Analysis for Growth Stocks versus Value Stocks

While fundamental analysis is essential for both growth and value stocks, the focus differs between the two. Growth stocks are typically evaluated based on their potential for future growth and expansion, while value stocks are assessed based on their current undervaluation compared to their intrinsic value.

Technical Analysis for Growth Stocks

Technical analysis plays a crucial role in identifying growth stock opportunities by analyzing past market data and trends to predict future price movements.

Common Technical Indicators for Analyzing Growth Stocks

When conducting technical analysis for growth stocks, investors often rely on the following indicators:

- Relative Strength Index (RSI): A momentum oscillator that measures the speed and change of price movements to determine overbought or oversold conditions.

- Moving Averages: Used to smooth out price data and identify trends over a specific period, such as the 50-day or 200-day moving average.

- MACD (Moving Average Convergence Divergence): Helps identify changes in a stock’s momentum, trend direction, and potential buy or sell signals.

Step-by-Step Guide on Conducting Technical Analysis for Growth Stocks

- Collect and Analyze Historical Price Data: Gather information on the stock’s past performance to identify trends and patterns.

- Identify Support and Resistance Levels: Determine key levels where the stock price has historically reversed or struggled to break through.

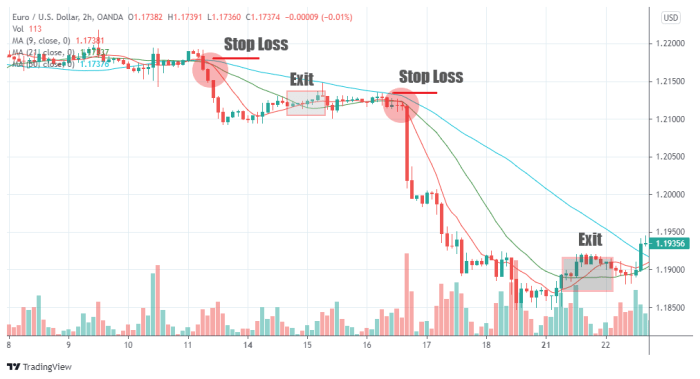

- Use Technical Indicators: Apply relevant indicators to your analysis, such as RSI, moving averages, and MACD, to confirm potential entry or exit points.

- Monitor Volume: Analyze trading volume to validate price trends and confirm the strength of a potential growth stock opportunity.

- Set Stop-Loss and Take-Profit Levels: Establish risk management strategies by setting stop-loss orders to limit losses and take-profit orders to secure profits.

Building a Diversified Growth Stock Portfolio

Diversification is crucial when building a growth stock portfolio as it helps spread risk and maximize potential returns. By investing in a mix of growth stocks across different sectors, investors can reduce the impact of volatility in any one industry.

The Importance of Diversification

Diversification is key to managing risk in a growth stock portfolio. By spreading investments across various sectors such as technology, healthcare, consumer goods, and finance, investors can mitigate the impact of any single sector downturn on their overall portfolio.

- Reduce Risk: Diversification helps protect against significant losses in case one sector underperforms.

- Maximize Returns: By investing in different sectors, investors can capture growth opportunities across various industries.

- Stability: A diversified portfolio can provide more stable returns over the long term.

Strategies for Selecting a Mix of Growth Stocks

When selecting growth stocks for a diversified portfolio, consider factors such as market trends, company performance, and growth potential. Look for companies with strong fundamentals, innovative products/services, and a track record of revenue growth.

Remember to research each company thoroughly and consider factors like earnings growth, market share, and competitive advantage.

- Research: Conduct in-depth research on potential growth stocks to understand their business models and growth prospects.

- Diversify Across Sectors: Invest in growth stocks from various sectors to minimize sector-specific risks.

- Long-Term Outlook: Focus on companies with sustainable growth potential over the long term.

Tips on Rebalancing and Managing a Diversified Growth Stock Portfolio

Regularly review and rebalance your diversified growth stock portfolio to ensure it aligns with your investment goals and risk tolerance. Rebalancing involves adjusting the allocation of assets based on market conditions and changes in your investment strategy.

- Review Performance: Monitor the performance of individual stocks and sectors to identify areas that may need adjustment.

- Rebalance Regularly: Adjust your portfolio allocations periodically to maintain the desired level of diversification.

- Stay Informed: Keep up with market trends and economic developments that may impact your growth stocks.