As forex trading strategies take the spotlight, get ready to dive into a world of financial finesse and market mastery. This introduction sets the stage for a riveting exploration of the strategies that drive success in the forex arena.

Get ready to uncover the secrets to navigating the forex market with confidence and skill.

Overview of Forex Trading Strategies

Forex trading strategies are specific techniques used by traders to determine when to enter or exit a trade in the foreign exchange market. These strategies are crucial for traders as they help in making informed decisions and maximizing profits while minimizing risks.

Types of Forex Trading Strategies

- Technical Analysis: This strategy involves analyzing historical price data and charts to predict future price movements.

- Fundamental Analysis: Traders using this strategy focus on economic indicators, news events, and market sentiment to make trading decisions.

- Sentiment Analysis: This strategy involves gauging the overall sentiment of market participants to predict market movements.

Short-term vs. Long-term Forex Trading Strategies

Short-term trading strategies involve making trades that last for a few minutes to a few days, while long-term strategies involve holding trades for weeks, months, or even years. Short-term strategies are more focused on technical analysis and quick profits, while long-term strategies are based on fundamental analysis and a broader market outlook.

Significance of Having a Well-Defined Trading Strategy in Forex

- Helps in managing risks: A well-defined trading strategy enables traders to set clear risk management rules and protect their capital.

- Guides decision-making: Having a trading strategy provides a roadmap for making trading decisions based on predefined criteria, rather than emotions or impulses.

- Improves consistency: Following a consistent trading strategy helps in maintaining discipline and avoiding impulsive trading behaviors that can lead to losses.

Fundamental Analysis Strategies

Fundamental analysis is a key component of forex trading strategies that focuses on evaluating the intrinsic value of currencies based on economic and geopolitical factors. By analyzing these fundamental factors, traders can make informed decisions about when to buy or sell a particular currency pair.

Key Economic Indicators

- Gross Domestic Product (GDP): GDP measures the total value of goods and services produced by a country. A strong GDP growth usually leads to a stronger currency.

- Unemployment Rate: High unemployment rates can indicate a weak economy and may lead to a depreciation of the currency.

- Consumer Price Index (CPI): CPI measures inflation and can impact interest rates set by central banks, influencing currency value.

Geopolitical Events Influence

- Trade Wars: Tariffs and trade disputes between countries can disrupt global trade and impact currency values.

- Political Instability: Elections, government changes, or geopolitical tensions can lead to uncertainty and affect currency markets.

- Natural Disasters: Events like earthquakes or hurricanes can disrupt a country’s economy and influence currency prices.

News Releases in Fundamental Analysis

- Interest Rate Decisions: Central banks announce interest rate changes, which can impact currency values as higher rates attract foreign investment.

- Economic Reports: Reports on employment, retail sales, and manufacturing data can provide insights into a country’s economic health and affect currency prices.

- Speeches by Central Bank Officials: Comments made by central bank officials can provide guidance on future monetary policy actions, influencing currency markets.

Technical Analysis Strategies

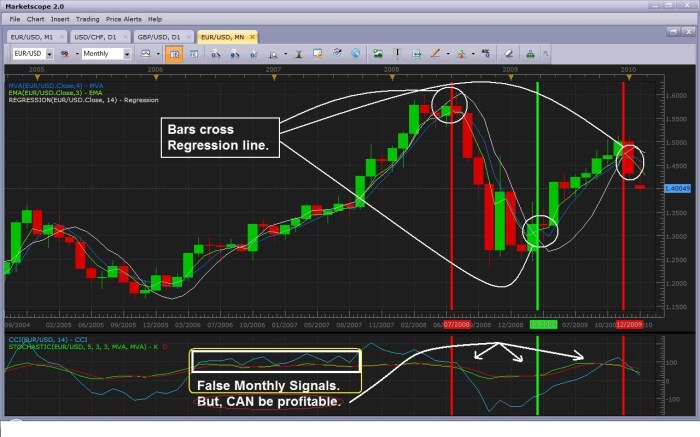

Technical analysis plays a crucial role in forex trading as it involves analyzing historical price data to identify potential trends and patterns in the market. By using technical analysis, traders can make informed decisions based on past price movements and market behavior.

Common Technical Indicators

- Moving Averages: Moving averages help smooth out price data to identify trends over a specific period. Traders often use the crossover of moving averages to signal potential buy or sell opportunities.

- Relative Strength Index (RSI): RSI measures the speed and change of price movements. It is used to determine overbought or oversold conditions in the market, indicating potential reversal points.

- MACD (Moving Average Convergence Divergence): MACD is a trend-following momentum indicator that shows the relationship between two moving averages of a security’s price. Traders use MACD to identify changes in momentum and potential trend reversals.

- Fibonacci Retracement: Fibonacci retracement levels are horizontal lines that indicate potential support and resistance levels based on the Fibonacci sequence. Traders use these levels to identify possible price correction areas.

Utilizing Chart Patterns

- Chart patterns such as head and shoulders, double tops, double bottoms, triangles, and flags can provide valuable insights into potential market movements. Traders analyze these patterns to predict future price directions and make trading decisions accordingly.

Risk Management in Forex Trading

Risk management is a crucial aspect of forex trading strategies as it helps traders protect their capital from excessive losses. By effectively managing risks, traders can stay in the game for the long run and minimize the impact of adverse market movements.

Position Sizing and Its Role in Managing Risk

Position sizing refers to determining the amount of capital to risk on each trade based on the trader’s risk tolerance and account size. It plays a vital role in managing risk by ensuring that no single trade has the potential to wipe out a significant portion of the trader’s account. By carefully calculating position sizes, traders can control their risk exposure and avoid catastrophic losses.

Stop-loss Orders and Take-profit Levels in Risk Management

Stop-loss orders are essential tools in risk management as they allow traders to set predetermined exit points to limit potential losses. By placing stop-loss orders, traders can protect their capital and prevent emotions from clouding their judgment during volatile market conditions. On the other hand, take-profit levels help traders lock in profits by setting target prices to exit winning trades. This strategy ensures that traders capitalize on favorable market movements and avoid giving back their gains.

Examples of Risk Management Techniques in Forex Trading

- Using a risk-reward ratio: Traders can set a specific ratio to determine the potential reward relative to the risk taken on each trade.

- Diversifying trades: By spreading out their investments across different currency pairs, traders can reduce the impact of any single trade on their overall portfolio.

- Implementing trailing stop-loss orders: Traders can adjust their stop-loss levels as the trade moves in their favor to lock in profits and minimize losses.

- Monitoring economic events: Keeping track of important economic releases and events can help traders anticipate market movements and adjust their positions accordingly.