As 401(k) withdrawal penalties take the spotlight, get ready to dive into a world filled with financial finesse and savvy. This intro sets the stage for a rollercoaster ride of insights, ensuring an experience that’s as informative as it is captivating.

In the following paragraphs, we’ll break down the nitty-gritty details of 401(k) withdrawal penalties, shedding light on what you need to know to make wise financial decisions.

Overview of 401(k) Withdrawal Penalties

401(k) withdrawal penalties are fees or charges imposed on individuals who take money out of their 401(k) retirement accounts before reaching a certain age or meeting specific criteria. These penalties are designed to discourage early withdrawals and promote long-term savings for retirement.

Types of 401(k) Withdrawal Penalties

- Early Withdrawal Penalty: This penalty is applied when a withdrawal is made from a 401(k) account before the age of 59 ½. The individual may face a 10% penalty on top of the regular income tax due on the withdrawn amount.

- Hardship Withdrawal Penalty: Some 401(k) plans allow for hardship withdrawals in cases of financial need, but these withdrawals are typically subject to penalties and may have limitations on the amount that can be withdrawn.

- Excess Contribution Penalty: If an individual contributes more than the allowed limit to their 401(k) account in a given year, they may face penalties on the excess contributions.

Early Withdrawal Penalties

When it comes to withdrawing money from your 401(k) before the age of 59½, you may face some hefty penalties. Let’s dive into what these penalties entail and how they can impact your retirement savings.

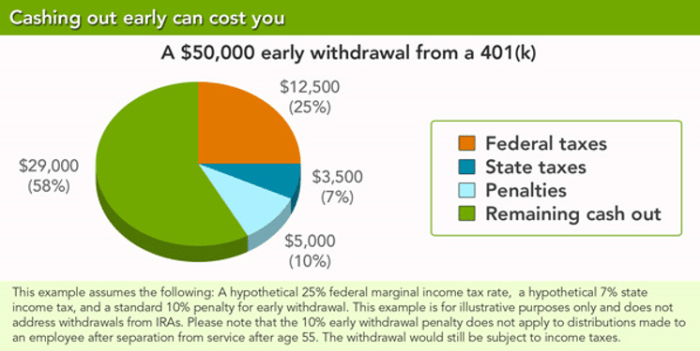

Early withdrawal penalties are designed to discourage individuals from tapping into their retirement funds prematurely. If you withdraw money from your 401(k) before the age of 59½, you can expect to face a 10% penalty on the amount withdrawn in addition to any taxes owed. This penalty is on top of the regular income taxes you will owe on the withdrawn amount.

Calculating Early Withdrawal Penalties

- Let’s say you withdraw $10,000 from your 401(k) before the age of 59½.

- You will owe a 10% early withdrawal penalty on the $10,000, which amounts to $1,000.

- In addition to the penalty, you will also owe income taxes on the $10,000 based on your tax bracket.

Tax Implications of Early Withdrawals

- Early withdrawals from a 401(k) are treated as ordinary income, meaning they are subject to income tax.

- Depending on your tax bracket, you could end up owing a significant amount in taxes on the withdrawn funds.

- It’s important to consider the tax implications before deciding to withdraw money early from your 401(k) to avoid any surprises come tax season.

Exceptions to Penalties

In some cases, individuals may be exempt from paying penalties for early 401(k) withdrawals. Let’s explore the rules and regulations surrounding penalty-free withdrawals from a 401(k) account and how one can qualify for these exceptions.

Hardship Withdrawals

- Hardship withdrawals allow penalty-free access to 401(k) funds in cases of immediate and heavy financial needs.

- Examples of situations that may qualify for hardship withdrawals include medical expenses, funeral costs, or preventing eviction or foreclosure.

- Documentation such as medical bills, eviction notices, or funeral expenses may be required to prove the need for a hardship withdrawal.

Age-Related Exceptions

- Individuals who are 59 ½ years old or older are typically exempt from early withdrawal penalties.

- Once you reach this age, you can start taking distributions from your 401(k) without facing the typical 10% penalty.

- It’s important to ensure that you have officially reached this age before making penalty-free withdrawals.

Impact of Penalties on Retirement Savings

Withdrawing funds early from your 401(k) can have a significant impact on the long-term growth of your retirement savings.

Comparison of Financial Consequences

When you take an early withdrawal from your 401(k) account, you not only incur penalties, but you also miss out on the potential growth of those funds over time. By leaving the money invested, you allow it to compound and grow, maximizing your retirement savings in the future.

Strategies for Minimizing Impact

- Consider alternative sources of funding before tapping into your 401(k) to avoid penalties.

- Explore loan options that may have lower interest rates compared to early withdrawal penalties.

- Consult with a financial advisor to evaluate all options and make an informed decision based on your specific financial situation.

- If facing financial hardship, research potential exceptions to penalties that may apply in your case.