Diving into the world of mortgage affordability calculators, this guide is your key to understanding how to determine how much you can afford to borrow. Get ready to explore the ins and outs of budgeting for your dream home with a touch of high school hip style.

From breaking down key factors to providing step-by-step instructions, this guide has everything you need to navigate the realm of mortgage affordability calculators like a pro.

What is a mortgage affordability calculator?

A mortgage affordability calculator is a tool used to help individuals determine how much they can afford to borrow when purchasing a home. It takes into account factors such as income, expenses, debt, and the desired loan term to calculate an estimate of the maximum loan amount a person can qualify for.

Purpose and Function

The mortgage affordability calculator serves as a financial planning tool to assist homebuyers in understanding their budget constraints and making informed decisions about buying a property. By inputting key financial information, such as income, monthly expenses, and potential interest rates, individuals can get a clear picture of what they can realistically afford in terms of a mortgage loan.

- One popular online mortgage affordability calculator is offered by Bankrate. It allows users to input their income, monthly debts, expected down payment, and interest rate to determine the maximum loan amount they can afford.

- Another well-known mortgage affordability calculator is provided by NerdWallet. This tool helps individuals estimate how much they can borrow based on their income, debts, and desired monthly payment.

Factors considered in a mortgage affordability calculator

When using a mortgage affordability calculator, several key factors are taken into account to determine how much a person can afford to borrow for a home loan. These factors help paint a clear picture of an individual’s financial situation and ensure that they do not take on more debt than they can handle.

Income

Income is a crucial factor in determining mortgage affordability. Lenders typically look at the borrower’s gross monthly income to assess how much they can afford to pay towards their mortgage each month. A higher income generally means a borrower can qualify for a larger loan amount.

Expenses

Expenses play a significant role in the affordability calculation as well. Lenders consider the borrower’s monthly debt obligations, such as credit card payments, car loans, and other liabilities, to determine how much they can comfortably afford to allocate towards a mortgage payment.

Down Payment

The down payment amount is another critical factor in the mortgage affordability calculation. A larger down payment reduces the loan amount needed, which can lower monthly payments and make the loan more affordable. Lenders often require a minimum down payment percentage, but a higher down payment can result in better loan terms.

Interest Rate

The interest rate on the mortgage loan significantly impacts affordability. A lower interest rate can result in lower monthly payments, making the loan more affordable over time. Borrowers with higher credit scores typically qualify for lower interest rates, which can positively impact affordability.

Loan Term

The loan term, or the length of time to repay the loan, is also considered in the affordability calculation. Shorter loan terms generally have higher monthly payments but lower overall interest costs, while longer loan terms result in lower monthly payments but higher total interest paid over the life of the loan.

Overall, changes in these factors can have a significant impact on mortgage affordability. For example, increasing income, reducing expenses, saving for a larger down payment, securing a lower interest rate, or choosing a shorter loan term can all lead to a more affordable mortgage payment and better financial stability in the long run.

How to use a mortgage affordability calculator

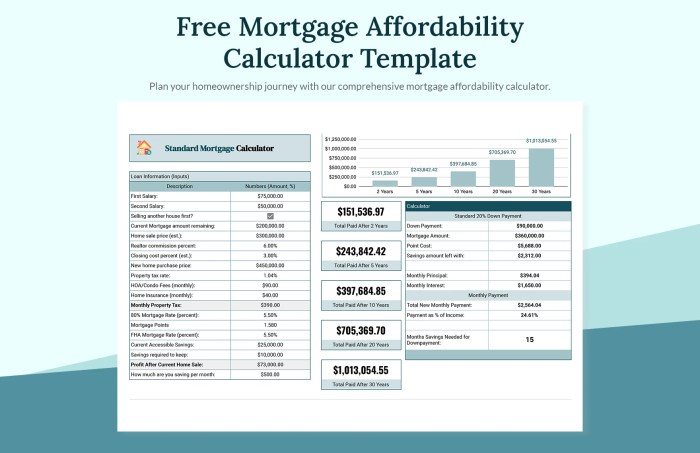

Using a mortgage affordability calculator is a straightforward process that can help you determine how much you can afford to borrow for a home loan. By inputting your financial information, you can get an estimate of the mortgage amount you may qualify for.

Step-by-step guide on using a mortgage affordability calculator

- Start by entering your gross annual income. This includes your salary before deductions.

- Input any monthly debts you have, such as student loans, car payments, or credit card debt.

- Enter your monthly expenses, including utilities, groceries, insurance, and other recurring costs.

- Provide information on the loan term you are considering, typically 15 or 30 years.

- Include the interest rate you expect to receive on the mortgage.

- Factor in the down payment amount you plan to make on the home.

Interpreting the results

Once you have entered all the necessary information, the mortgage affordability calculator will generate an estimate of the maximum mortgage amount you can afford based on your financial situation. It will also show you the estimated monthly payment and the total interest you would pay over the life of the loan.

Remember, the results from the calculator are just estimates. Your actual mortgage eligibility will depend on various factors, including your credit score, debt-to-income ratio, and the lender’s specific requirements.

Benefits of using a mortgage affordability calculator

Using a mortgage affordability calculator before applying for a home loan can have several advantages. It can help individuals set realistic budget goals, avoid overextending financially, and make informed decisions when comparing different loan scenarios.

Setting Realistic Budget Goals

- By inputting your income, expenses, and other financial details into a mortgage affordability calculator, you can get a clear picture of how much you can afford to spend on a mortgage each month.

- This helps you set realistic budget goals and ensures that you don’t take on a loan that is beyond your means.

Avoiding Overextension

- Calculating your mortgage affordability can prevent you from overextending financially by showing you the maximum loan amount you can comfortably repay.

- It helps you avoid the risk of falling behind on payments or facing financial strain due to a mortgage that is too expensive.

Making Informed Decisions

- A mortgage affordability calculator allows you to compare different loan scenarios, such as varying interest rates or down payments, to see how they impact your monthly payments.

- With this information, you can make informed decisions about which loan option is best suited to your financial situation and long-term goals.