Diving into the world of personal loans, this guide is here to break it down for you in a way that’s easy to digest. From understanding the ins and outs of getting a personal loan to exploring the various factors that lenders consider, this article is your go-to source for all things personal loan-related.

Get ready to level up your financial knowledge and take charge of your borrowing options with this in-depth exploration of how to secure a personal loan.

Introduction to Personal Loans

A personal loan is a type of loan that allows individuals to borrow money for various purposes, such as consolidating debt, making a large purchase, or covering unexpected expenses. Unlike other types of loans, personal loans are unsecured, meaning they do not require collateral.

People often consider taking out personal loans for reasons such as:

- Debt consolidation: Combining multiple debts into one loan with a lower interest rate

- Home improvement: Renovating or repairing a home

- Medical expenses: Covering medical bills or procedures

- Weddings: Funding a wedding or honeymoon

- Travel: Financing a vacation or trip

Types of Personal Loans

There are several types of personal loans available in the market to cater to different needs:

- Secured Personal Loans: Require collateral, such as a car or savings account, to secure the loan

- Unsecured Personal Loans: Do not require collateral but may have higher interest rates

- Fixed-Rate Personal Loans: Maintain a constant interest rate throughout the loan term

- Variable-Rate Personal Loans: Have an interest rate that can fluctuate based on market conditions

- Debt Consolidation Loans: Specifically designed to consolidate multiple debts into a single loan

Factors to Consider Before Applying for a Personal Loan

When it comes to applying for a personal loan, there are several key factors that lenders take into consideration before approving your application. Understanding these factors can help you better prepare and increase your chances of getting approved for the loan you need.

Credit Score Importance

Your credit score plays a crucial role in determining whether you qualify for a personal loan and what interest rate you may be offered. Lenders use your credit score to evaluate your creditworthiness and assess the risk of lending money to you. A higher credit score typically indicates responsible financial behavior and makes you a more attractive borrower.

Income and Employment Stability

Income and employment stability are also significant factors that lenders consider when reviewing your personal loan application. Lenders want to ensure that you have a steady income to make timely loan payments and reduce the risk of default. Having a stable job and consistent income can increase your chances of loan approval.

Other Factors Considered by Lenders

In addition to credit score, income, and employment stability, lenders may also look at other factors before approving a personal loan. Some of these factors include your debt-to-income ratio, existing debt obligations, the purpose of the loan, and your repayment history on previous loans. Providing accurate and complete information about these factors can help lenders make an informed decision about your loan application.

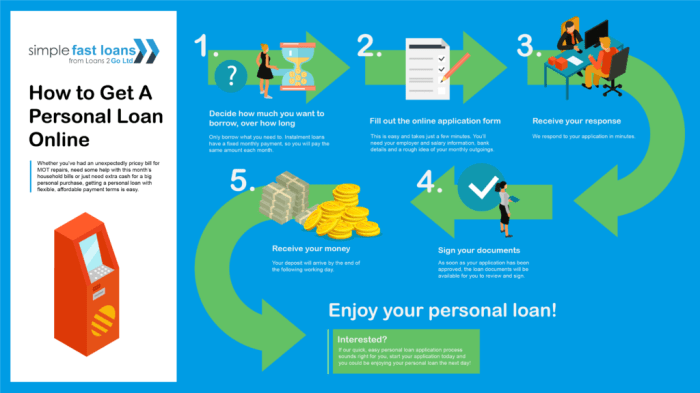

How to Apply for a Personal Loan

Applying for a personal loan can be a straightforward process if you know what to expect. Here are the general steps involved in applying for a personal loan, the documentation required, and tips to improve your chances of approval.

General Steps in Applying for a Personal Loan

- Research and Compare: Look at different lenders and their terms to find the best fit for your financial situation.

- Check Eligibility: Ensure you meet the lender’s requirements for credit score, income, and other criteria.

- Submit Application: Fill out the application form with accurate information and submit it along with the required documents.

- Wait for Approval: The lender will review your application and make a decision on whether to approve your loan.

- Receive Funds: If approved, the funds will be disbursed to your account, usually within a few business days.

Documentation Required for a Personal Loan Application

- Proof of Identity: Driver’s license, passport, or other government-issued ID.

- Proof of Income: Pay stubs, tax returns, or bank statements to verify your income.

- Credit History: Your credit report will be checked to assess your creditworthiness.

- Collateral Documents: If you’re applying for a secured loan, you may need to provide documents related to the collateral.

Tips to Improve Your Chances of Getting Approved for a Personal Loan

- Improve Your Credit Score: Pay off debts, make payments on time, and correct any errors on your credit report.

- Reduce Debt-to-Income Ratio: Lower your existing debt or increase your income to improve your debt-to-income ratio.

- Provide Accurate Information: Make sure all the information on your application is correct and up to date.

- Add a Co-Signer: If your credit is not strong enough, consider adding a co-signer with good credit to increase your chances of approval.

Understanding Interest Rates and Fees

When it comes to personal loans, understanding interest rates and fees is crucial to managing your finances effectively. Let’s delve into the details to help you make informed decisions.

Interest Rates and Their Impact

Interest rates determine the cost of borrowing money. They are calculated as a percentage of the principal loan amount and can significantly affect the total amount you repay. A higher interest rate means you’ll pay more over the loan term, while a lower rate can save you money.

Types of Fees

- Origination Fees: These are charged by the lender for processing your loan application and are usually a percentage of the loan amount.

- Late Payment Fees: If you miss a payment deadline, you may incur a late fee, which can increase your overall loan cost.

- Prepayment Penalties: Some lenders charge a fee if you pay off your loan early. Make sure to check if this applies to your loan.

Comparing Loan Offers

When comparing loan offers, look beyond just the interest rate. Consider the total cost of the loan, including fees. Use the Annual Percentage Rate (APR) as a tool to compare different loan offers accurately. The APR includes both the interest rate and any applicable fees, giving you a comprehensive view of the total cost.

Repayment Options and Terms

When it comes to personal loans, understanding the repayment options and terms is crucial to managing your finances effectively. By exploring the common repayment options available and getting a grasp of the loan terms, you can stay on track with your payments and avoid defaulting.

Common Repayment Options

- Fixed Monthly Payments: With this option, you pay a set amount each month until the loan is fully repaid.

- Variable Payments: Your monthly payments may vary based on interest rate changes, affecting the total repayment amount.

- Bi-weekly Payments: Making payments every two weeks instead of monthly can help you pay off the loan faster and reduce interest costs.

Understanding Loan Terms

- Repayment Schedule: It is essential to know when your payments are due and the total duration of the loan to plan your finances accordingly.

- Interest Rates: Be aware of the interest rates applied to your loan, as they can significantly impact the total amount you repay over time.

- Fees and Penalties: Understand the fees associated with late payments or prepayment, as they can add to the overall cost of the loan.

Managing Loan Repayments

- Create a Budget: Develop a budget that includes your loan payments to ensure you allocate enough funds each month.

- Automate Payments: Set up automatic payments to avoid missing due dates and incurring late fees.

- Communicate with Lender: If you encounter financial difficulties, contact your lender to discuss possible repayment options or modifications.

Alternatives to Personal Loans

When considering borrowing money, personal loans are not the only option available. It’s important to explore alternative financial solutions to determine the best choice for your specific situation.

Credit Cards

- Credit cards are a common alternative to personal loans, offering a line of credit that can be used for purchases or cash advances.

- Pros: Convenient access to funds, potential rewards or cashback offers, and the ability to build credit with responsible use.

- Cons: Higher interest rates compared to personal loans, potential for overspending and accumulating debt, and fees for cash advances.

Lines of Credit

- Lines of credit are another option that provides access to funds up to a predetermined limit, similar to a credit card.

- Pros: Flexibility to borrow as needed, lower interest rates compared to credit cards, and the ability to establish a financial safety net.

- Cons: Variable interest rates, the potential for overspending, and the requirement to make minimum monthly payments.

When Personal Loans Might Not Be the Best Choice

- Emergency Expenses: For immediate financial needs, credit cards or a line of credit may offer quicker access to funds compared to the application process for a personal loan.

- Short-Term Financing: If you only need to borrow a small amount for a short period, a credit card with a promotional 0% APR offer may be more cost-effective than a personal loan.

- Debt Consolidation: While personal loans can be used for debt consolidation, balance transfer credit cards with a 0% APR introductory period may provide a more affordable solution.