Yo, peeps! Dive into the world of financial ratios as we break it down for you in a way that’s fresh and funky. Get ready to learn how these numbers can unveil the true story behind a company’s performance.

In this guide, we’ll explore the importance, types, interpretation, and limitations of financial ratios to help you navigate the complex world of financial analysis.

Importance of Financial Ratios

Financial ratios are crucial tools used by investors and analysts to assess the performance and financial health of a company. These ratios provide valuable insights into various aspects of a company’s operations, profitability, liquidity, and solvency. By analyzing these ratios, investors can make informed decisions regarding whether to invest in a particular company or not.

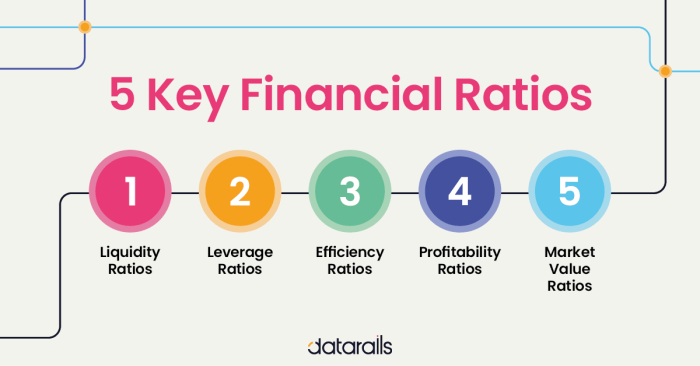

Key Financial Ratios

- Profitability Ratios: These ratios, such as return on equity (ROE) and gross profit margin, help investors gauge how efficiently a company is generating profits.

- Liquidity Ratios: Ratios like current ratio and quick ratio indicate a company’s ability to meet its short-term financial obligations.

- Debt Ratios: Debt-to-equity ratio and interest coverage ratio show the amount of debt a company has in relation to its equity and its ability to cover interest payments.

- Efficiency Ratios: Inventory turnover ratio and accounts receivable turnover ratio assess how effectively a company is managing its assets.

Informed Investment Decisions

Financial ratios play a crucial role in helping investors make informed investment decisions. By comparing a company’s ratios to industry benchmarks or historical data, investors can identify strengths and weaknesses, assess risk levels, and determine the company’s overall financial stability. This analysis enables investors to make sound investment choices based on solid financial data rather than speculation or gut feelings.

Types of Financial Ratios

Financial ratios are essential tools used by investors, analysts, and companies to evaluate a company’s financial health and performance. There are four main categories of financial ratios: liquidity ratios, solvency ratios, profitability ratios, and efficiency ratios. Each type serves a specific purpose in assessing different aspects of a company’s financial situation.

Liquidity Ratios

Liquidity ratios measure a company’s ability to meet its short-term obligations. The most common liquidity ratios include the current ratio and the quick ratio. The formula for the current ratio is:

(Current Assets / Current Liabilities)

This ratio helps determine if a company can pay off its short-term debts with its current assets. For example, a current ratio of 2 means the company has twice as many current assets as liabilities, indicating good liquidity.

Solvency Ratios

Solvency ratios focus on a company’s long-term financial stability and ability to meet its long-term debt obligations. The debt-to-equity ratio and interest coverage ratio are common solvency ratios. The formula for the debt-to-equity ratio is:

(Total Debt / Total Equity)

This ratio shows the proportion of debt a company uses to finance its operations compared to shareholders’ equity.

Profitability Ratios

Profitability ratios measure a company’s ability to generate profits relative to its revenue, assets, or equity. Common profitability ratios include the gross profit margin, net profit margin, and return on equity (ROE). The net profit margin formula is:

((Net Income / Revenue) x 100)

This ratio indicates how much of each dollar earned by the company translates into profit after all expenses are accounted for.

Efficiency Ratios

Efficiency ratios assess how well a company utilizes its assets and liabilities to generate revenue. The inventory turnover ratio and asset turnover ratio are examples of efficiency ratios. The formula for the inventory turnover ratio is:

(Cost of Goods Sold / Average Inventory)

This ratio shows how many times a company sells and replaces its inventory during a specific period.

By analyzing these different types of financial ratios, investors and stakeholders can gain valuable insights into a company’s financial performance and make informed decisions about investing or lending to the company.

Interpreting Financial Ratios

To assess a company’s financial position, it’s essential to interpret financial ratios accurately. These ratios provide valuable insights into various aspects of a company’s performance and financial health.

Understanding Ratio Values

- Profitability Ratios: A high gross profit margin indicates efficient production processes, while a low net profit margin may suggest high operating expenses.

- Liquidity Ratios: A current ratio above 1 indicates a company can cover its short-term liabilities, while a quick ratio excludes inventory from current assets to provide a more conservative measure.

- Debt Ratios: A high debt-to-equity ratio may signal financial risk, while interest coverage ratio measures a company’s ability to pay interest on its debt.

Analyzing Trends Over Time

Examining trends in financial ratios over time can reveal crucial information about a company’s financial health. Consistent improvement in profitability ratios may indicate effective cost management strategies, while declining liquidity ratios could point to potential cash flow issues.

Limitations of Financial Ratios

Financial ratios are valuable tools for analyzing a company’s financial health, but they do have limitations that need to be considered.

External factors can significantly impact the interpretation of financial ratios. For example, changes in economic conditions, industry trends, or regulatory changes can all affect how financial ratios are viewed. In addition, different accounting methods used by companies can also distort the ratios and make comparisons challenging.

Impact of External Factors

- Changes in the economy can skew ratios: Economic downturns can make a company’s financial ratios look worse than they actually are, while economic booms can have the opposite effect.

- Industry-specific trends: Ratios can vary widely across different industries, making it difficult to compare companies in different sectors.

- Regulatory changes: New regulations can impact how financial information is reported, affecting the accuracy of ratios.

Scenarios of Inaccurate Reflection

- Seasonal businesses: Companies with seasonal fluctuations may show skewed ratios at certain times of the year, giving a false impression of their overall financial health.

- Highly leveraged companies: Financial ratios may not accurately reflect the true financial status of companies with high levels of debt, as debt can distort key ratios like profitability and solvency.

- Rapidly growing companies: Fast-growing companies may appear healthy based on current ratios, but if they are funding growth through debt or equity, their long-term financial stability could be in question.