With Investment research tools at the forefront, this paragraph opens a window to an amazing start and intrigue, inviting readers to embark on a storytelling american high school hip style filled with unexpected twists and insights.

Investment research tools are the key to navigating the complex world of finance, providing investors with valuable insights and data to make informed decisions. From analyzing market trends to identifying profitable opportunities, these tools revolutionize the way investments are approached and managed.

Overview of Investment Research Tools

Investment research tools are like a secret weapon for investors, helping them navigate the complex world of finance with confidence. These tools provide valuable insights, analysis, and data to help investors make informed decisions about where to put their hard-earned cash.

Purpose of Investment Research Tools

- Research tools help investors analyze market trends and performance of various securities.

- They provide access to financial data, company reports, and expert analysis to guide investment decisions.

- These tools help investors identify potential risks, opportunities, and trends in the market.

Popular Investment Research Tools

- Yahoo Finance: A comprehensive platform offering stock market data, news, and analysis.

- Bloomberg Terminal: A professional-grade tool providing real-time financial data and analytics.

- Morningstar: Known for its mutual fund and stock research, ratings, and analysis.

- Seeking Alpha: A platform for crowd-sourced investment research and analysis.

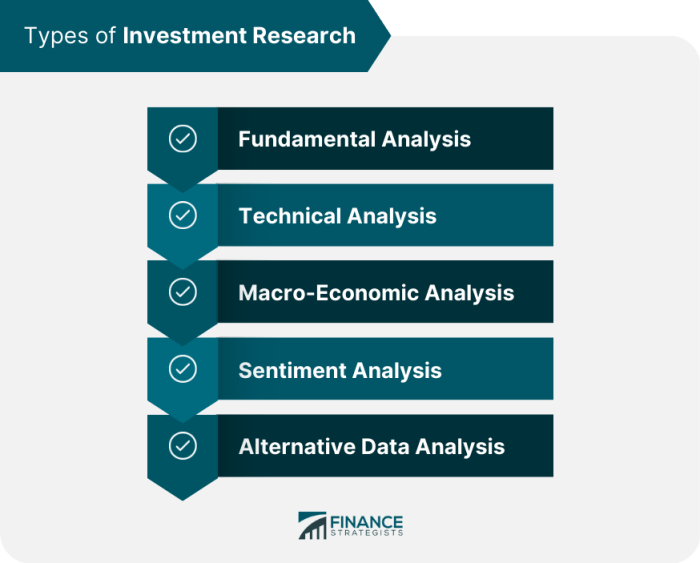

Types of Investment Research Tools

Investment research tools can be broadly categorized into fundamental analysis tools and technical analysis tools. Each type serves a unique purpose and offers distinct features and functionalities to assist investors in making informed decisions.

Fundamental Analysis Tools

Fundamental analysis tools focus on evaluating the intrinsic value of a security by analyzing various economic, financial, and qualitative factors. These tools help investors understand the financial health and performance of a company to determine if its stock is undervalued or overvalued. Some key features and functionalities of fundamental analysis tools include:

- Financial Ratios: Tools that calculate and analyze key financial ratios such as price-to-earnings ratio (P/E), earnings per share (EPS), and return on equity (ROE).

- Income Statements and Balance Sheets: Tools that provide detailed financial statements to assess a company’s revenue, expenses, assets, and liabilities.

- Valuation Models: Tools that help investors estimate the fair value of a stock based on various valuation methods like discounted cash flow (DCF) analysis or comparable company analysis.

Technical Analysis Tools

Technical analysis tools focus on studying historical price and volume data to forecast future price movements of a security. These tools analyze market trends, patterns, and indicators to help investors identify potential entry and exit points. Some key features and functionalities of technical analysis tools include:

- Charts and Graphs: Tools that display price movements through charts and graphs, allowing investors to visually analyze trends and patterns.

- Technical Indicators: Tools that apply mathematical calculations to price and volume data to generate signals for buying or selling a stock, such as moving averages, relative strength index (RSI), and MACD.

- Backtesting: Tools that enable investors to test trading strategies using historical data to evaluate their effectiveness and profitability.

Benefits of Using Investment Research Tools

Investment research tools offer numerous advantages to investors, helping them make informed decisions and maximize their returns. Let’s delve into how these tools can benefit investors in various ways.

Save Time for Investors

Investment research tools streamline the process of analyzing vast amounts of data and information, saving investors valuable time. By providing quick access to key metrics, market trends, and financial reports, these tools enable investors to make efficient decisions without spending hours conducting manual research.

Identifying Profitable Investment Opportunities

These tools play a crucial role in identifying profitable investment opportunities by offering in-depth analysis and insights. By utilizing features like stock screeners, financial modeling tools, and market scanners, investors can pinpoint undervalued assets, high-growth stocks, and potential market trends, helping them capitalize on lucrative opportunities.

Reducing Risks Associated with Investments

Investment research tools contribute significantly to reducing risks associated with investments by providing comprehensive risk assessment tools and portfolio analysis features. Investors can assess the risk-return profile of their investments, diversify their portfolios effectively, and implement risk management strategies based on data-driven insights, ultimately minimizing potential losses and protecting their capital.

Key Features to Look for in Investment Research Tools

When evaluating investment research tools, it is crucial to consider key features that can enhance your decision-making process and maximize your investment potential.

Real-Time Data Updates

- Access to real-time data allows investors to make informed decisions based on the most up-to-date information available in the market.

- Timely updates on stock prices, market trends, and financial news can help investors stay ahead of the curve and capitalize on opportunities as they arise.

Customizable Alerts

- Customizable alerts enable users to set notifications for specific criteria such as price changes, earnings reports, or market volatility.

- These alerts can help investors track their investments more effectively and react promptly to any significant developments in the market.

User-Friendly Interfaces

- Intuitive and easy-to-navigate interfaces are essential for investors to efficiently access and analyze the wealth of information provided by research tools.

- A user-friendly design enhances the overall user experience, making it easier for investors to find the data they need and make well-informed decisions.

Comprehensive Financial Analysis Capabilities

- Tools that offer comprehensive financial analysis capabilities can provide investors with in-depth insights into company performance, industry trends, and market dynamics.

- Features such as financial statement analysis, ratio calculations, and benchmarking tools can help investors evaluate investment opportunities more thoroughly and accurately.

How to Choose the Right Investment Research Tool

When it comes to choosing the right investment research tool, it’s essential to consider your individual investment needs. Not all tools are created equal, and what works for one investor may not work for another. Here are some tips on how to evaluate different tools based on your specific requirements.

Factors to Consider

- Cost: Determine your budget for an investment research tool. Some tools may come with a hefty price tag, while others may offer more affordable options.

- Data Accuracy: Check the accuracy of the data provided by the tool. Reliable and up-to-date information is crucial for making informed investment decisions.

- Customer Support: Look for tools that offer excellent customer support. In case you encounter any issues or have questions, it’s important to have reliable assistance.

Checklist for Selecting a Research Tool

- Define Your Investment Goals: Understand what you aim to achieve with your investments, whether it’s long-term growth, income generation, or capital preservation.

- Evaluate Features: Make a list of features that are important to you, such as portfolio analysis, market research, stock screening, or technical analysis tools.

- Read Reviews: Check out reviews from other investors to get an idea of the tool’s performance, ease of use, and overall satisfaction level.

- Free Trials: Take advantage of free trials offered by research tools to test their functionality and see if they meet your needs.

- Compare Options: Compare different tools side by side to see which one offers the best value for your investment style and preferences.