Buckle up, folks! We’re diving headfirst into the world of FICO scores. Get ready for a rollercoaster ride through the ins and outs of this crucial financial metric, all served up with a side of American high school hip style.

So, what exactly are FICO scores and why should you care? Let’s break it down in a way that’s as cool as a varsity jacket on a Friday night football game.

Understanding FICO Scores

FICO scores are numerical representations of an individual’s creditworthiness, indicating how likely they are to repay borrowed money. These scores play a crucial role in financial matters, influencing loan approvals, interest rates, and other financial opportunities.

Calculation of FICO Scores

FICO scores are calculated based on several factors, including payment history, amounts owed, length of credit history, new credit, and types of credit used. Each factor carries a different weight in determining the overall score.

- Payment History: This accounts for the largest portion of the FICO score and reflects whether payments are made on time.

- Amounts Owed: This considers the amount of debt owed compared to the available credit.

- Length of Credit History: This looks at how long accounts have been open and the time since the last activity.

- New Credit: Opening multiple new accounts in a short period can negatively impact the score.

- Types of Credit Used: Having a mix of credit types, like credit cards and loans, can positively influence the score.

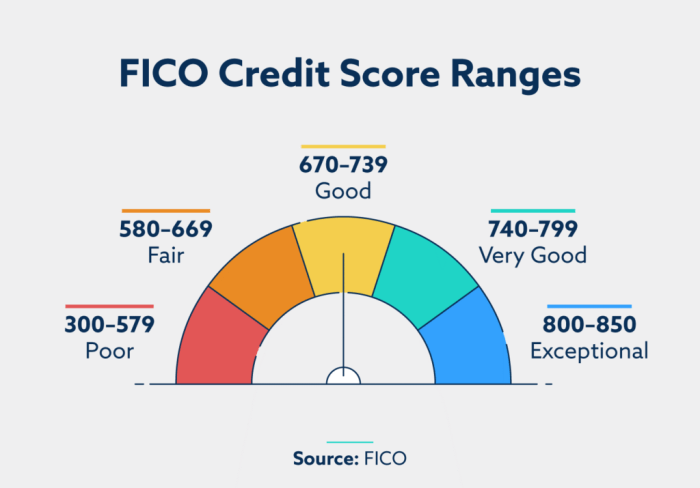

Range of FICO Scores and Impact

FICO scores typically range from 300 to 850, with higher scores indicating better creditworthiness. A good FICO score is usually considered to be above 670, although scores above 800 are considered excellent. Having a higher FICO score can lead to better borrowing opportunities, lower interest rates, and higher credit limits.

Importance of FICO Scores

Having a good FICO score is crucial in today’s financial world as it directly impacts your ability to obtain loans, credit cards, and favorable interest rates. Your FICO score, which ranges from 300 to 850, is a numerical representation of your creditworthiness based on your credit history.

Impact on Financial Decisions

- FICO scores can affect renting an apartment: Landlords often check credit scores to assess the risk of potential tenants defaulting on rent payments.

- Getting insurance: Insurance companies may use your FICO score to determine premiums for auto, home, or life insurance policies.

- Job opportunities: Some employers may review FICO scores as part of the hiring process, especially for positions involving financial responsibilities.

Having a good FICO score opens doors to better financial opportunities and can save you money in the long run.

Improving FICO Scores

To improve your FICO scores, it is essential to implement positive financial habits that demonstrate responsibility and reliability to creditors and lenders. By focusing on strategies such as paying bills on time, reducing debt, and monitoring credit reports regularly, you can work towards boosting your FICO scores over time.

Timeline for Seeing Improvements

After implementing positive financial habits like paying bills on time and reducing debt, you can typically start to see improvements in your FICO scores within a few months to a year. However, the timeline for significant improvements may vary depending on individual circumstances and the extent of the changes made to your financial behavior.

Debt Consolidation vs. Credit Counseling

When it comes to boosting FICO scores, there are different methods to consider, such as debt consolidation and credit counseling. Debt consolidation involves combining multiple debts into a single loan with a lower interest rate, which can help simplify payments and reduce overall debt. On the other hand, credit counseling involves working with a financial professional to create a plan for managing debt and improving credit scores through budgeting and financial education. Both methods can be effective in improving FICO scores, but it’s essential to choose the option that aligns best with your financial goals and circumstances.

Common Misconceptions about FICO Scores

Misconceptions about FICO scores are widespread, leading many people to make decisions based on inaccurate information. Let’s debunk some of the common myths and misunderstandings surrounding FICO scores to help you better understand your credit health.

Checking your own credit score does not hurt your FICO score

Contrary to popular belief, checking your own credit score, also known as a soft inquiry, does not have any negative impact on your FICO score. In fact, monitoring your credit score regularly can help you stay on top of your financial health and identify any potential issues early on.

Closing a credit card account can affect your FICO score

Another common misconception is that closing a credit card account will always improve your credit score. In reality, closing a credit card account can actually have a negative impact on your FICO score. This is because it can reduce your overall available credit limit, which may increase your credit utilization ratio and lower your score.