Get ready to dive into the exciting realm of international investments, where opportunities abound and risks are ever-present. This guide is your ticket to understanding the ins and outs of global economic strategies, from foreign direct investments to successful international investment tactics.

Whether you’re a novice looking to dip your toes into the international market or a seasoned investor seeking to expand your portfolio, this guide has got you covered with all the essential information you need to know.

Overview of International Investments

International investments refer to the allocation of capital in assets outside of one’s own country. This practice plays a significant role in the global economy by fostering economic growth, diversification, and increased market efficiency.

Types of International Investments

- Foreign Direct Investment (FDI): This involves a company from one country making a physical investment in another country, such as setting up a factory or acquiring a stake in a local business.

- Portfolio Investment: This type of investment involves buying securities or financial assets in foreign markets, such as stocks, bonds, or mutual funds.

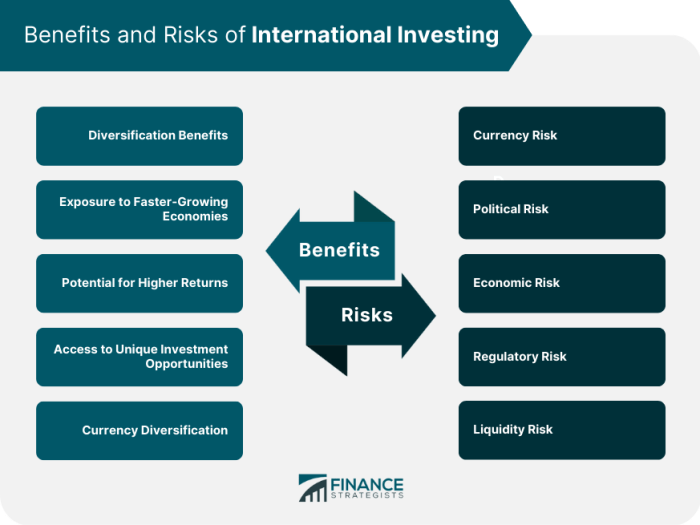

Benefits and Risks of International Investments

- Benefits:

Increased diversification: International investments allow investors to spread risk across different markets and industries.

Access to new markets: Investing internationally provides access to new consumer bases and revenue streams.

- Risks:

Exchange rate risk: Fluctuations in currency values can impact the returns on international investments.

Political and regulatory risks: Changes in government policies or unstable political environments in foreign countries can affect investments.

Factors Influencing International Investments

Investing internationally involves a complex mix of factors that can impact the decisions made by individuals or entities. These factors can range from political instability to economic conditions and even social and cultural norms in different countries. Understanding these factors is crucial for successful international investments.

Political Factors Affecting International Investments

Political stability and government policies can greatly influence international investments. Unstable political environments, frequent changes in leadership, or government interventions in the economy can create uncertainty for investors. On the other hand, countries with stable governments and favorable policies towards foreign investments can attract more capital from abroad.

Economic Factors Impacting Decisions on International Investments

Economic factors such as exchange rates, inflation, interest rates, and GDP growth play a significant role in determining the attractiveness of a country for investments. A strong economy with low inflation and stable currency can provide a conducive environment for investment opportunities. On the contrary, high inflation rates and volatile currency exchange can deter investors.

Social and Cultural Factors in International Investments

Social and cultural factors can also influence international investments. Factors such as labor laws, workforce skills, consumer behavior, and cultural norms can impact the success of investments in a foreign country. Understanding the local culture and social dynamics is essential for making informed investment decisions and building successful business relationships.

International Investment Strategies

When it comes to international investments, investors employ various strategies to maximize their returns and manage risks effectively. Let’s dive into the different strategies used and compare short-term versus long-term approaches.

Different Strategies Used by Investors

- Diversification: Investors spread their investments across different countries to reduce risk.

- Market Timing: Investors buy and sell assets based on market trends and economic conditions.

- Foreign Direct Investment (FDI): Investors establish a physical presence in a foreign country by investing in businesses or infrastructure.

Short-term vs. Long-term International Investment Strategies

Short-term strategies focus on capitalizing on immediate market opportunities and quick gains, while long-term strategies involve holding investments for an extended period to benefit from gradual growth and compounding returns.

Examples of Successful International Investment Strategies

| Industry | Strategy | Outcome |

|---|---|---|

| Tech | Investing in emerging markets early | High returns as markets mature |

| Real Estate | Strategic partnerships with local developers | Access to prime locations and steady rental income |

| Healthcare | Acquiring established international companies | Expansion into new markets and increased market share |

Global Investment Trends

In today’s dynamic global market, international investments are influenced by various trends that shape the landscape of financial opportunities around the world. Let’s explore some of the key trends impacting global investment decisions.

Tech-driven Investment Strategies

Technology has revolutionized the way investments are made, with the rise of robo-advisors, algorithmic trading, and artificial intelligence. These technological advancements have enabled investors to make data-driven decisions, optimize portfolio management, and access global markets more efficiently. The use of fintech solutions has also democratized investing, allowing individuals from different regions to participate in international markets with ease.

Regional Investment Shifts

Different regions are experiencing shifts in investment trends based on economic conditions, political stability, and market opportunities. For example, emerging markets in Asia are attracting significant investments due to rapid growth rates and technological innovation. On the other hand, traditional investment hubs like Europe and North America are adapting to changing consumer preferences and regulatory environments, leading to diversification of investment portfolios across sectors and geographies.

Sustainability and ESG Factors

The focus on sustainability and Environmental, Social, and Governance (ESG) factors is increasingly influencing international investment decisions. Investors are prioritizing companies that demonstrate strong ethical practices, environmental stewardship, and social responsibility. This trend is reshaping industries and driving capital towards businesses that align with sustainable and responsible practices, reflecting a shift towards long-term value creation and risk management in global investments.