Diving into the world of compound interest investments, we embark on a journey filled with potential and growth. From the magic of compounding to the strategies for maximizing returns, this exploration promises to be both enlightening and rewarding.

As we delve deeper into the realm of compound interest investments, we uncover the secrets behind its ability to multiply wealth over time and the various factors that impact investment growth.

Introduction to Compound Interest Investments

Compound interest investments are a type of investment where the interest earned on the initial investment is reinvested, allowing the investment to grow at an accelerated rate over time.

Compound interest works by calculating interest not only on the initial investment but also on the accumulated interest from previous periods. This means that the interest earned in each period is added to the principal amount, resulting in a higher base for calculating interest in the next period.

For example, let’s say you invest $1,000 in a compound interest account with an annual interest rate of 5%. In the first year, you would earn $50 in interest, bringing your total investment to $1,050. In the second year, you would earn 5% interest on $1,050, resulting in $52.50 in interest. This process continues, with the interest compounding each year and accelerating the growth of your investment over time.

Benefits of Compound Interest Investments

- Accelerated Growth: Compound interest allows your investment to grow faster over time compared to simple interest.

- Increased Returns: The reinvestment of earned interest leads to higher returns on your initial investment.

- Long-Term Wealth Building: Compound interest is ideal for long-term investments, helping you build wealth steadily over time.

Types of Compound Interest Investments

When it comes to compound interest investments, there are several types of investment vehicles that you can consider. Each type has its own unique features and benefits that can help you grow your money over time.

Stocks

Stocks represent ownership in a company and can offer the potential for high returns over the long term. When you invest in stocks, you are buying a share of the company’s profits and assets. The compound interest in stocks comes from reinvesting dividends and capital gains back into more shares, allowing your investment to grow exponentially.

Bonds

Bonds are debt securities issued by corporations or governments. They pay a fixed interest rate over a specific period of time. The compound interest in bonds comes from reinvesting the interest payments you receive, allowing your investment to grow over time.

Mutual Funds

Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities. The compound interest in mutual funds comes from the reinvestment of dividends and capital gains, similar to stocks.

Savings Accounts

Savings accounts are a low-risk investment option offered by banks and credit unions. They pay interest on your deposited funds, and the compound interest in savings accounts comes from the interest being added back to your principal amount, allowing your money to grow over time.

Remember, the frequency at which compound interest is calculated can impact your investment growth. The more frequent the compounding, the faster your money can grow. So, choose your investment vehicles wisely based on your financial goals and risk tolerance.

Calculating Compound Interest

When it comes to calculating compound interest on investments, it’s important to understand the formula and steps involved. Compound interest is the interest calculated on the initial principal and also on the accumulated interest of previous periods. This means that your money can grow exponentially over time, as you earn interest on both your principal and the interest already earned.

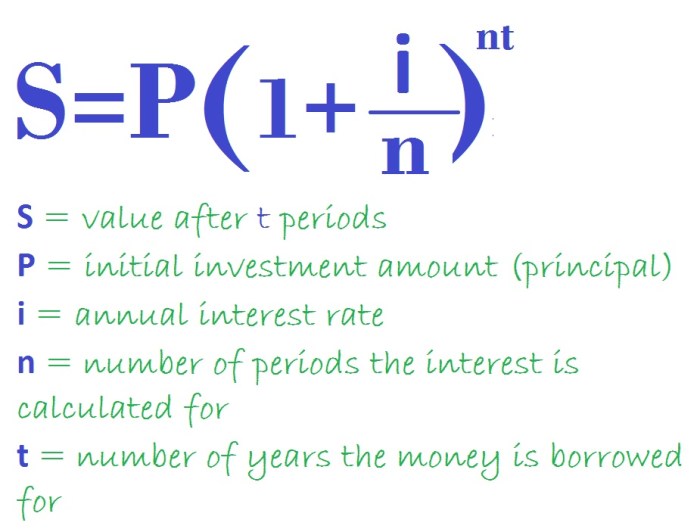

Formula for Calculating Compound Interest

Compound Interest = P(1 + r/n)^(nt) – P

Where:

– P is the principal amount (initial investment)

– r is the annual interest rate (in decimal form)

– n is the number of times that interest is compounded per year

– t is the number of years the money is invested for

To calculate compound interest on investments, follow these steps:

1. Determine the principal amount (P), the interest rate (r), the number of compounding periods per year (n), and the number of years the money will be invested for (t).

2. Plug these values into the compound interest formula.

3. Calculate the compound interest by subtracting the principal amount from the total amount after compounding.

Impact of Interest Rates and Compounding Periods

- Higher interest rates lead to faster growth of investments due to more significant returns on the principal amount.

- More compounding periods per year result in higher overall returns, as interest is calculated and added more frequently.

- Combining a high-interest rate with more compounding periods can greatly accelerate the growth of your investment over time.

Strategies for Maximizing Compound Interest Investments

Compound interest investments can be a powerful tool for growing wealth over time. By following certain strategies, investors can maximize their returns and take full advantage of the compounding effect. One of the key strategies is to start early and stay invested for the long term. This allows your initial investment to grow exponentially over time, as the interest compounds on both the principal and the accumulated earnings. Another effective strategy is to reinvest the earnings generated from your investments back into the principal amount. This accelerates the growth of your investment by increasing the base on which the interest is calculated. By consistently reinvesting your earnings, you can see significant growth in your investment portfolio over time.

Benefits of Starting Early and Staying Invested

- Starting early allows you to take advantage of the power of compounding over a longer period.

- Staying invested for the long term helps you weather market fluctuations and benefit from the overall growth of the investment.

- Compound interest investments have a snowball effect, where the earnings generate more earnings, leading to exponential growth.

Reinvesting Earnings to Accelerate Growth

- Reinvesting your earnings increases the principal amount, leading to higher interest calculations.

- Compound interest can significantly boost your investment returns when earnings are reinvested rather than withdrawn.

- Automatic reinvestment of dividends or interest can help you capitalize on the power of compounding without any extra effort.

Risks and Considerations in Compound Interest Investments

When considering compound interest investments, it’s crucial to understand the potential risks involved and factors that can impact your investment decisions.

In the world of compound interest investments, there are several risks that investors should be aware of. These risks can include market volatility, inflation, and economic conditions. Understanding these risks is essential to making informed investment choices and maximizing your returns.

Market Volatility

Market volatility refers to the rapid and unpredictable price movements in the financial markets. This can lead to fluctuations in the value of your investments, impacting your overall returns. It’s important to be prepared for market volatility and have a diverse investment portfolio to help mitigate potential losses.

Inflation

Inflation is the rate at which the general level of prices for goods and services rises, leading to a decrease in purchasing power. Inflation can erode the real value of your investments over time, reducing the actual returns you earn. When choosing compound interest investments, it’s crucial to consider inflation rates and seek investments that can outperform inflation to maintain your purchasing power.

Economic Conditions

Economic conditions, such as recessions or economic downturns, can have a significant impact on your compound interest investments. During challenging economic times, interest rates may be low, affecting the growth of your investments. It’s essential to monitor economic indicators and adapt your investment strategies accordingly to navigate changing economic conditions effectively.